Good morning contrarians!

Stocks are flat in the pre-market after a nice rebound yesterday. There was some sustained buying into the close with the Nasdaq the biggest winner, up 1.6%.

Today as of 0550, major U.S. indexes are right around the break-even point. Notable individual stocks making moves include Devon Energy (DVN), up 5%, and Hilton Worldwide (HLT), down 2.5%. Those are both due to earnings.

Bonds are mixed this morning and the yield curve is flattening. The 2-year yield is up 5 basis points to 2.78% whilst the 10-year is flat at 2.99%. It briefly broached 3% yesterday.

Commodities aren’t doing much with WTI crude oil down 1% to trade around $104/barrel. Copper is up 1.5%. Cryptos are flat with bitcoin down less than 1% to trade around $38,500.

Economic Data Releases

The Job Openings and Labor Turnover Survey, or JOLTS, for March is out at 1000. Economists expect the report to show an even 11 million job openings, down a bit from the 11.3 million seen in last month’s report. But the JOLTS report also has a number of very interesting details that are worth looking at.

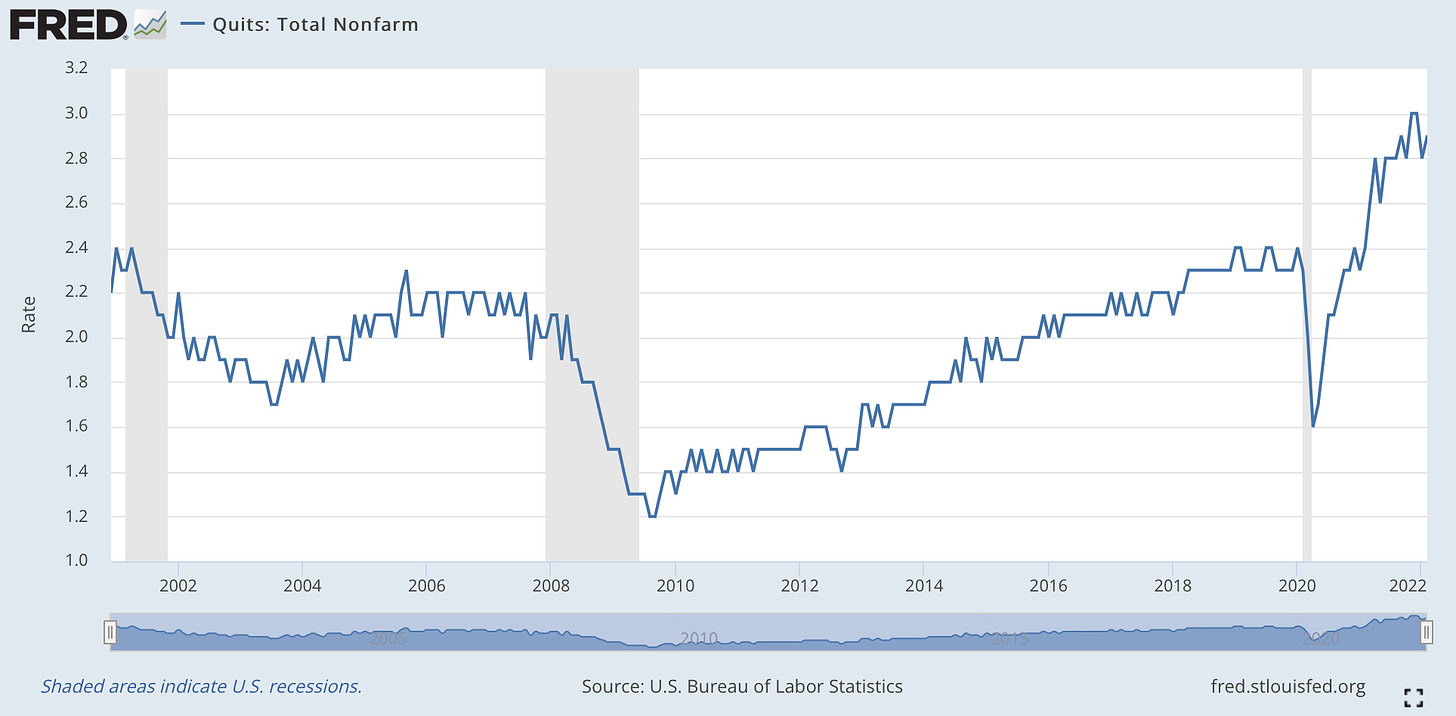

The ‘Quits Rate’ is a favorite. This shows the percentage of people who willingly left the workforce, presumably to seek other employment. It was at an all-time high of 3% across all industries in November and December, but declined a bit at the start of the year. The cool thing about quits levels data is it breaks out by state and industry. Fed chair Jerome Powell himself has cited this metric in his press conferences.

At the same time as the JOLTS report we’ll get factory orders from the U.S. Census Bureau. This is expected to increase by 1.1% month-over-month after a 0.5% decline in February. We haven’t had two negative months in a row for this since the height of Covid in March and April 2020. So this could be important to watch, especially since economists are predicting an increase.

Earnings

We’re still in the middle of earnings season as well. Today we’re due to hear from DuPont (DD), Hilton Worldwide (HLT), Molson Coors (TAP) Pfizer (PFE), Cummins (CMI), Estée Lauder (EL), Marathon Petroleum (MPC), Paramount Global (PARA), AIG (AIG), Airbnb (ABNB), Caesars (CZR), Match Group (MTCH), and Starbucks (SBUX) are among the highlights.

The Bottom Line

Yesterday’s rally was encouraging, but bear markets are no strangers to rallies. The market has been behaving very bearishly for most of the year. Can’t remember the last time we had two positive days in a row for stocks.

That all of this is going on as bonds continue to sell off is unusual. Usually one rises at the other’s expense (in bear markets it’s usually bonds. We haven’t seen that yet, partly due to interest rates, which is one thing maybe bulls can cling to for hope).

One sign that the consumer staples trade may have played out comes from the Wall Street Journal this morning. If the mainstream financial press is noticing a trend, the trend may already be over. The Journal is not as big a contrarian indicator as others (cough, Barron’s), but still probably a good idea to look elsewhere for opportunity.

JOLTS, Factory Orders: Daily Contrarian, May 3