Good morning contrarians! It is Friday, Oct. 7.

Stocks finished lower yesterday, dropping into the close. Dow Industrials declined by 1.2% to lead major US indexes down whilst the S&P 500 fell by 1%. We got some bad news after the close from AMD (AMD 0.00%↑), which pre-announced earnings that fell well short of estimates. That stock is down close to 6% overnight.

State of Play

As of 0630 there isn’t much doing ahead of the crucial non-farm payrolls report out at 0830:

Stocks futures are mostly flat. Only the Nasdaq is moving at all, down 0.5% presumably on the AMD news;

Commodities aren’t doing much either. WTI crude oil is up 1% to trade around $89/barrel;

Cryptos are down a bit, with Bitcoin down 0.8% to drop below $20,000;

Bonds are about unchanged. The 2-year yield is up 3 basis points to 4.28% whilst the 10-year is up 3bps to 3.85% (yields move inversely to prices).

Non-Farm Payrolls

NFPs are out at 0830. Economists expect a print of 250,000, down from 315,000 seen last month, with the unemployment rate holding steady at 3.7%. Average hourly earnings are expected to come in roughly unchanged, at 5.1% (5.2% last month).

The 250k figure would be the lowest of the year. You have to go back to November and December to see anything comparable. So that would be a pretty clear sign that the labor market is finally starting to cool. The JOLTS report from Tuesday kind of showed this as well, though initial jobless claims are still low (219,000 this week as of yesterday, still well below where this figure was in July).

Worth pointing out that the NFPs often deviate widely from forecasts. Sometimes by several hundred thousand jobs. You’d figure this might make investors a bit skeptical of this figure, but it still seems to hold their attention more than any other (other than the inflation data these days).

The Bottom Line©

This is just one NFP report. The market reaction, however, is likely to be violent. Here the formula is the same it’s been: investors will root for a soft number signifying a slowing labor market simply because it would bring more hope of a quicker Fed pivot away from interest rate hikes. If this report shows plentiful job creation north of the 250,000 mark, then markets could freak out.

It stands to reason that there is more downside ahead simply because the Fed has said it’s their mission to kill inflation even if it breaks the economy. We aren’t there yet. In the US at least, nothing really looks broken. Consumers have been able to afford the higher prices for goods and services. Of course; talk is cheap. The market is calculating that if there is a real pain point in the economy, the Fed will probably see it as reason enough to pivot and flood the market with liquidity again.

Perhaps this calculation will even be right. But the ‘pain point,’ wherever it ends up occurring, is likely to cause a blast radius with second- and third-order effects. The damage will likely be widespread, perhaps even in areas none of us can envision right now. Unwinds of this magnitude are very rarely painless.

Remember too that it takes up to a year for Fed rate hikes to work their way through the economy. This tightening cycle started in March. That puts us seven months in. Potentially still months away from when things even start breaking.

That all makes for a guarded market. Sure, there’s a chance investors could throw caution to the wind and bid up assets into year-end. But with all this uncertainty still out there, it’s difficult to make the case for taking risks. Markets hate uncertainty more than they hate bad news.

Famous last words. Now watch the market rally. Nobody knows what’s going to happen after all. Yet another reason to do your own research, make your own decisions.

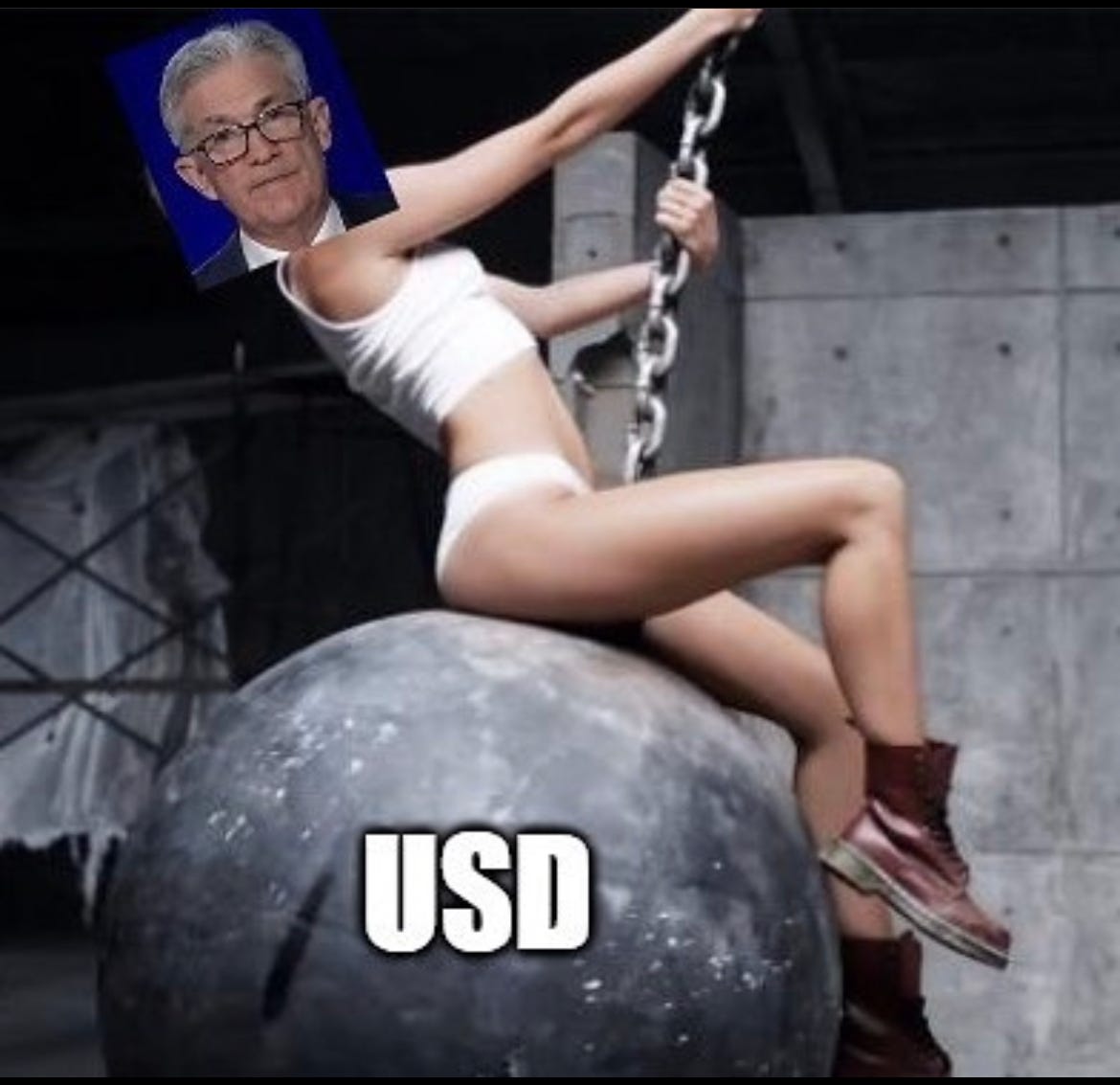

Non-Farm Payrolls, Fed Wrecking Ball