Good morning contrarians!

Stock futures are a bit higher as of 0625. Tech is leading things out, with the Nasdaq up 0.5% and other U.S. indexes up a little less. Some positive earnings reports after yesterday’s close helped risk appetite overseas, with Alibaba (BABA) up 14% to help boost shares in Hong Kong.

Bonds are continuing to see bids as well, however. The yield on the 2-year is down about 3 basis points to 2.46% with the 10-year down 2bps to 2.74% (yields move inversely to prices). Commodities are mostly flat with WTI crude oil unchanged at $113.50/barrel, but natural gas in the U.S. is down 2.5% and some metals (notably silver and nickel) are up. Cryptos are down a bit with bitcoin off about 0.7% to trade right around $29,000.

Inflation Reading

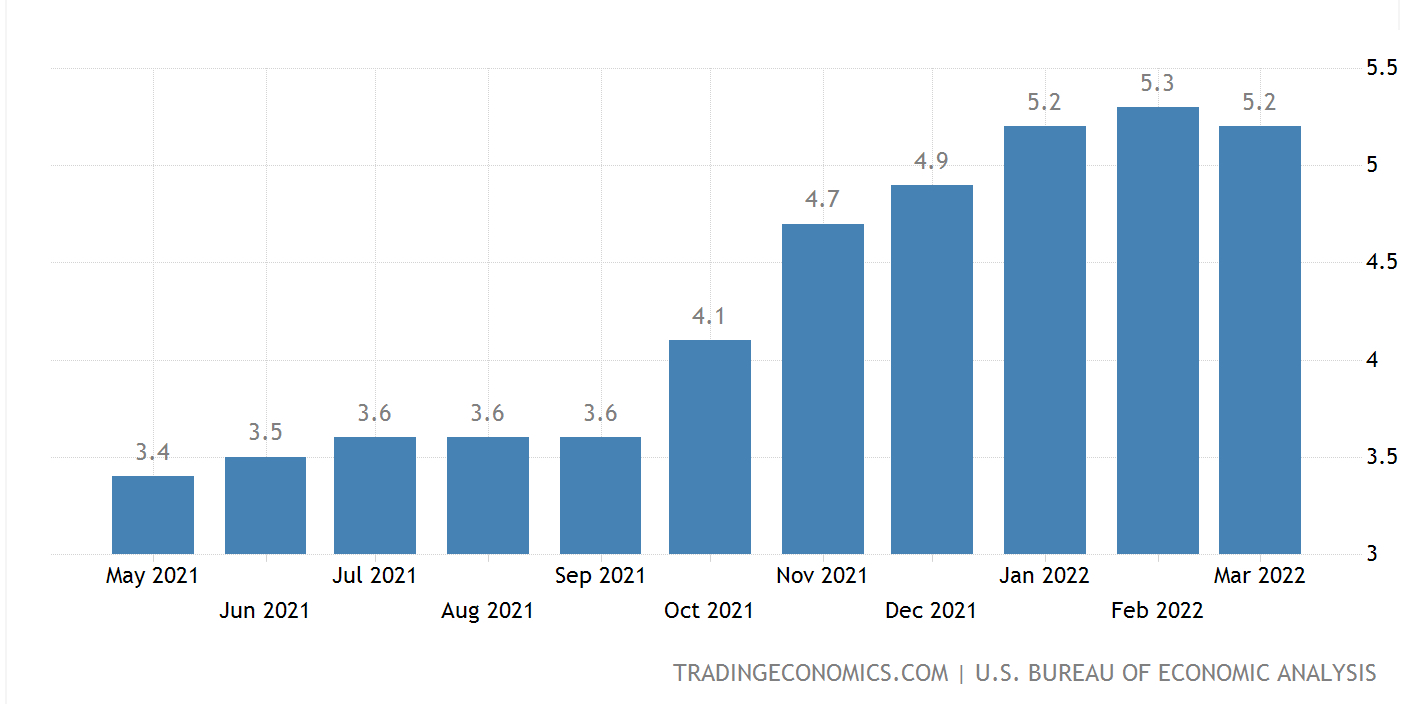

The Bureau of Economic Analysis’s Personal Consumption Expenditures Price Index, aka the PCE Deflator, is out at 0830. This is the Federal Reserve’s preferred gauge of inflation in the U.S. The most important metrics here are the year-over-year increase in prices and the YoY increase excluding food and energy. The first is expected to have increased by 6.3% YoY in April after printing at 6.6% YoY in March. The core figure is anticipated at 4.9% YoY after 5.2% YoY at the last reading a month ago.

As you can see from the chart, this would indicate inflation (at least by this gauge) has peaked in February and is now waning. Our guest from this week’s podcast, Ayesha Tariq, had some thoughts on this that are worth checking out (especially because as a premium subscriber you have exclusive access to this episode right now. It isn’t available to the unwashed masses yet).

Earnings

Another big (pun intended) retailer is due to report today with Big Lots (BIG) due before the open at 0930.

Most retailers have had positive earnings; Dollar Tree (DLTR) and Dollar General (DG) yesterday beat analyst estimates and raised outlooks as consumers become more price conscious due to inflation. Ulta Beauty (ULTA) also rallied after earnings but Gap (GPS) dropped after slashing its profit guidance. Much-anticipated Costco (COST) beat top- and bottom-line estimates but for whatever reason investors sold the stock and it’s dropped 2% overnight.

The Bottom Line©

What a difference a week makes. Seven days ago we were preparing for a bear market, now everybody seems optimistic again. Which take was right? Well, the latest one of course. Until new information becomes available to disprove that.

That new information will become available at 0830 with the PCE deflator report. If this comes in hot and shows inflation is rising again, then it will surely be bad for markets all around. If it prints soft and shows that the inflation waning trend is real, it could make for a rally in risk assets. The calculus here is simply that less pressure on the Fed to raise rates is better.

It is a Friday before the first holiday weekend of the summer here in the U.S. Usually these trading days are pretty quiet, especially in the afternoon. But we’ll have to see exactly how much Sturm und Drang (German term loosely translated as mad drama) this PCE report kicks up.

And yeah, markets are closed on Monday so no podcast. Have a great holiday weekend.

PCE Deflator to Supply Fresh Inflation Take: Daily Contrarian, May 27