(Updates with quarterly earnings below)

Good morning contrarians!

Stock futures are rising a day after posting decidedly mixed results. Tech stocks sold off, with the Nasdaq dropping over 1% whilst Dow Jones Industrials gained 0.7% and the S&P 500 was flat.

State of Play

Today as of 0635, tech is leading the bounce, with the Nasdaq up 1%. The other indexes are up a little less. Among individual stocks, Tesla (TSLA) is rallying, up 7% after posting impressive results after the close yesterday. Airlines are rallying with United Airlines (UAL) and American Airlines (AAL) up 8% and 5%, respectively. On the opposite side of the ledger, Vornado (VNO) is down 5%.

Bonds are selling off a bit, with the yield on the 2-year up 4 basis points to 2.61% and the 10-year up 3bps to 2.87%. Yields move inversely to prices.

Commodities aren’t doing much. WTI crude oil is sitting at $103/barrel, up less than 1%. Cryptos are quiet as well, with bitcoin up 1% to trade around $42,000.

Economic Data Releases

The Philadelphia Fed produces its April manufacturing index and accompanying survey, out at 0830. Economists expect the index to print at 21, which would be a drop from the 27.4 seen last month. But arguably more important than the headline number are the nature of the responses in the Philly Fed’s survey.

Manufacturing may not be as significant as it once was in the U.S. (though it is likely to regain luster with all the re-shoring from China), but this survey is still closely watched. Of particular importance is what respondents have to say about inflation.

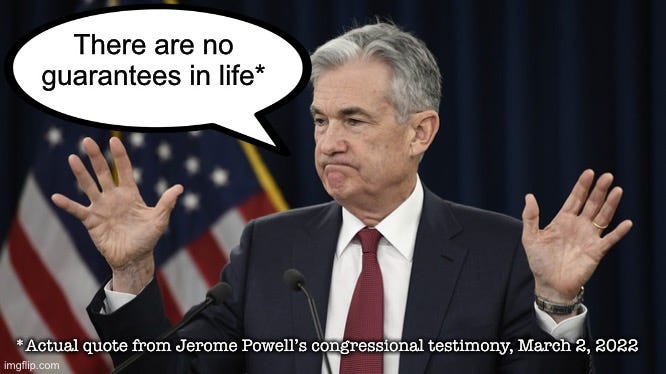

Fed chair Jerome Powell is due to speak at the IMF conference at 1300. Fed officials have been banging the drum pretty hard on rate hikes lately. St. Louis Fed President James Bullard was the latest to ratchet up the rhetoric, saying a 0.75% increase could be an option. Our latest podcast guest, Edward Olanow of Weiss Multi-Strategy Advisers, calls this jawboning by the Fed. (Consider this your friendly reminder to listen to that podcast, which posted last night and is available just to you as a premium subscriber for now).

Finally, seeing how it’s Thursday we also have initial jobless claims, also at 0830. Economists expect 180,000 new claims this week, down a bit from the 185,000 seen last week. The post-pandemic low is 166,000 set a fortnight ago.

Earnings

Another busy day of earnings awaits. Dow (DOW) just beat on top- and bottom-line estimates. AT&T (T) was mixed. American Airlines (AAL) beat on top-and bottom-line estimates and that stock is rallying. Philip Morris (PM), Marsh & McLennan (MMC), and Tractor Supply (TSCO) also beat EPS and revenue estimates. Pool (POOL) beat and raised guidance.

After the close at 1600 we’ll get Las Vegas Sands (LVS), Snap (SNAP), Boston Beer Co. (SAM), and Freeport-McMoran (FCX),

The Bottom Line

A divergence appears to be underway: Companies with inelastic (economic term) products and which report solid earnings with optimistic guidance are being rewarded, with investors bidding up their stock prices. Those in crowded markets hawking discretionary goods or services and whose earnings do not meet analyst estimates are punished.

At least, that’s the narrative. There are some gaps here. For one, you have companies like Tesla whose expensive electric vehicles don’t quite meet the inelasticity of demand measure. And travel is the ultimate discretionary purchase, but airlines are being bid up this morning after UAL’s results.

Will be interesting to see if Powell can shift the narrative away from earnings and back to the Fed. He’s usually been the voice of dovishness against all this hawkish rhetoric. If that pattern holds today, it could boost stocks.

Where this all leaves tech is an open question. The numbers don’t lie there and most of those stocks are 50% or more off of their highs.

Philly Fed, Powell Speech, More Earnings: Daily Contrarian, April 21