Good morning contrarians! Welcome to the Daily Contrarian, our morning look at events likely to move markets. It is Thursday, Dec. 12. The Bottom Line segment of today’s podcast starts at (4:20), followed by Stocks on the Contrarian Radar©️ featuring LMT 0.00%↑ and GD 0.00%↑ at (6:34) for listeners who want to skip ahead.

State of Play

Stocks advanced yesterday led by tech after CPI matched economist estimates. As we eye our board of indicators for signs of direction at 0700, things are pretty quiet:

Stock index futures are down a bit led by tech with the Nasdaq down 0.3%. S&P 500 futures are down 0.2%;

Cryptos are advancing again. Bitcoin is up 2% to move north of $100,000 again;

Commodities aren’t doing much. WTI crude oil is unchanged at $70.50/barrel and copper is up 0.6%;

Bonds are dropping a bit. The 2-year yield is up 2 basis points to 4.18% whilst the 10-year is up 3bps to 4.30% (yields move inversely to prices).

Today’s Known Events

Yesterday we had consumer prices, today it’s the turn of producers. Also known as wholesale prices, this datapoint is arguably more important than the CPI under the premise that producers pass higher costs off to consumers.

Anyway here are the economist estimates for today’s PPI:

Monthly headline PPI of 0.2%, the same as last month;

Annualized headline PPI of 2.6 versus 2.4% last month;

Monthly Core PPI of 0.2% (0.3% previous);

Annualized Core PPI of 3.2% (3.1%).

Seeing how it’s Thursday we’ll also get initial jobless claims at 0830. The expectation here is for 221,000 new claims, effectively in line with the 224,000 recorded last week but ahead of the four-week average of 218,000.

There are some earnings but those aren’t until after the close at 1600: Broadcom (AVGO 0.00%↑) and Costco (COST 0.00%↑) are the highlights.

The Bottom Line

Inflation is a concern with consumer prices continuing to advance. They just didn’t advance more than economists had estimated, which was good enough for stocks to rally yesterday. What that tells us is that investors really want to take on risk and were itching for an excuse to do so.

Producers prices today should be able to bring the fear of God back, but this datapoint is rarely acted on by markets. Maybe today will be different? The move upward in bond yields — indicating selling in bonds — tells us that maybe all is not as rosy as tech stocks and cryptos indicate.

‘Fighter jets scrutinized by traders on stock exchange’ by author via Grok

Stocks on the Contrarian Radar©️

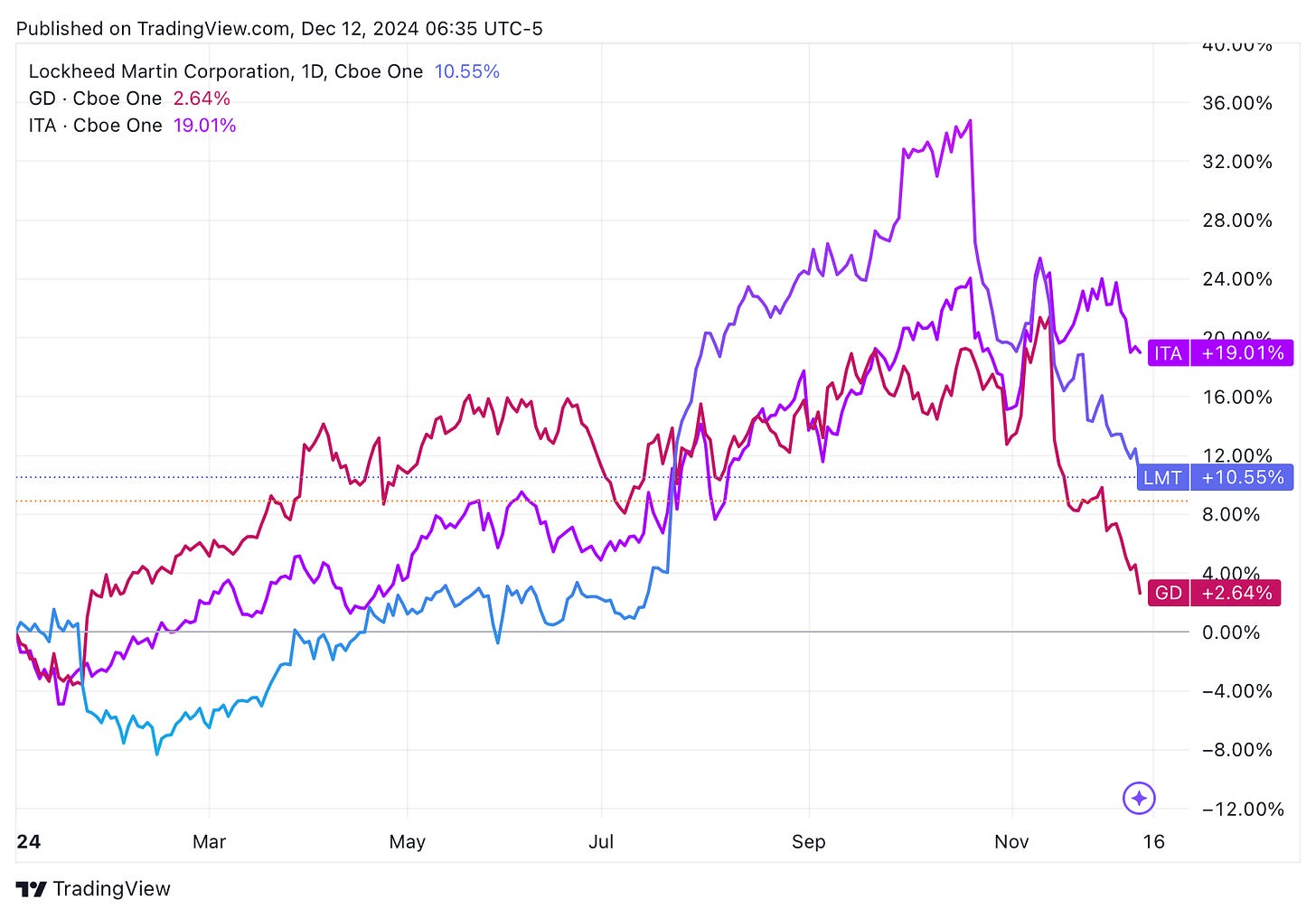

Defense contractors dropped yesterday and overnight led by Lockheed Martin (LMT 0.00%↑) and General Dynamics (GD 0.00%↑). The catalyst appears to have been a report by JPMorgan that said these companies could face Department Of Government Efficiency (DOGE) risks once Donald Trump and Elon Musk take office. There are clearly other things affecting LMT however as the stock is down some 12% over the last month:

At issue may be margin pressure, with gross margins down to 12% according to the last earnings report, versus a sector median of 32%. Well okay. How about valuations?

LMT trades at ~19x forward earnings, a bit below the sector median of 24x. Price-to-sales are 1.7x, which isn’t great. Price-to-cashflows are 15x, which isn’t great either. The latter two multiples are a bit worse than the sector median.

GD trades at ~20x forward earnings, 1.5x sales, and 15x cashflows, so in a similar range.

Add it up and these stocks are neither cheap nor expensive. If you zoom out a bit on the chart you can see that LMT has advanced by 10% this year, with GD up just 2.6%. So both trail their benchmark, the iShares Aerospace & Defense ETF (ITA 0.00%↑):

Still, you can’t help but be a little tempted after the pullback. Frankly it sounds like any DOGE concerns are completely unfounded. Elon & Co. may be serious about cutting government spending — or think they’re serious — but nobody is going to cut defense budgets. In fact, they aren’t even going to slow the increase of defense spending. To do so would be political suicide — and they know it. Besides, Musk’s companies are direct beneficiaries of government contracts, especially from the defense department. Musk may be crazy AF judging by some of his social media posts and other evidence, but he’s not going to bite off the hand that feeds him.

Full disclosure: The Contrarian does not own LMT or GD and is not going to enter any orders to buy at this time. If it keeps dropping he will reconsider.

Not investment advice!

Previously In This Space…

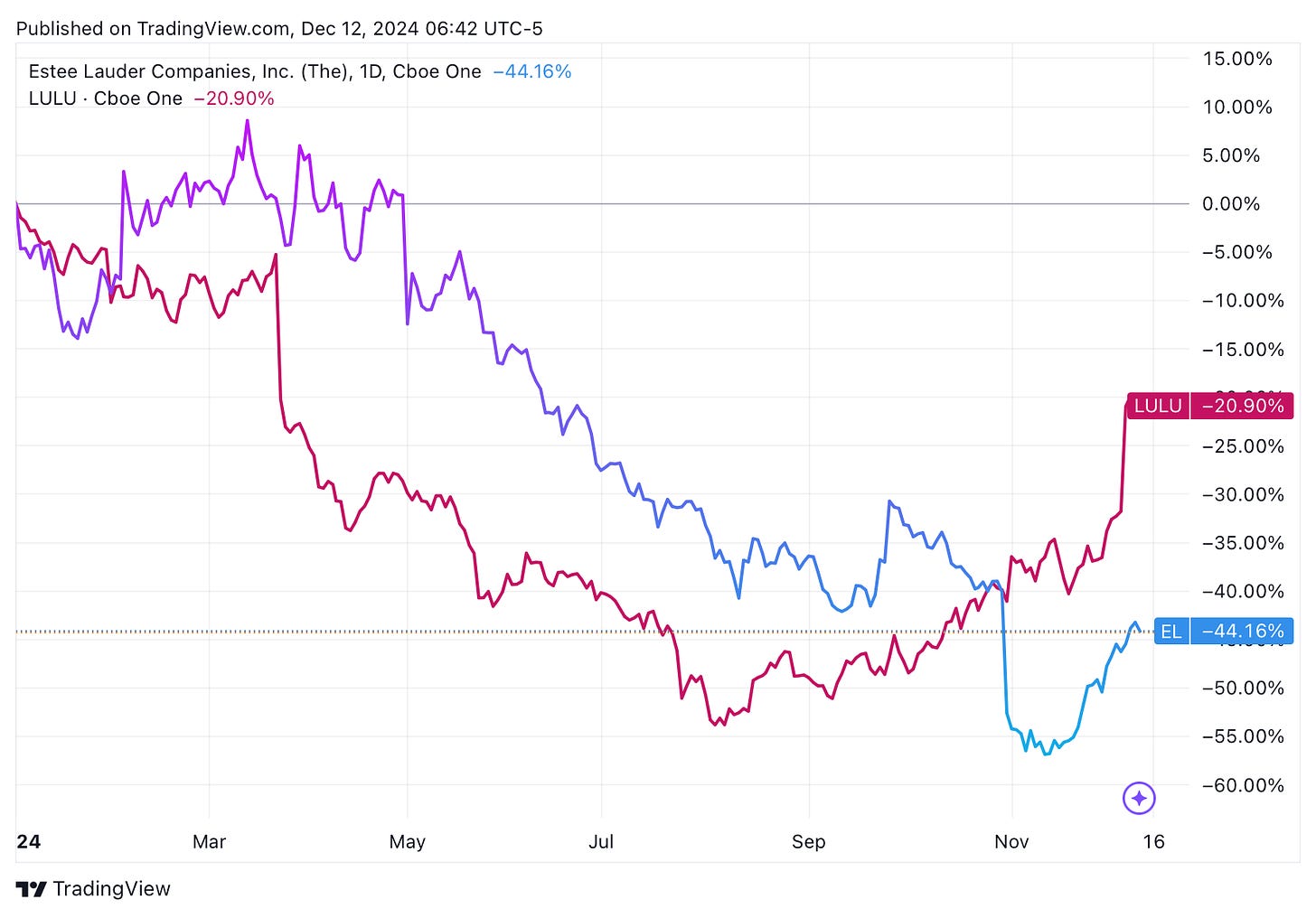

This July we examined a sell-off in fashion stocks Estée Lauder (EL 0.00%↑), and Lululemon (LULU 0.00%↑), deciding they were probably best avoided.

…And What Happened

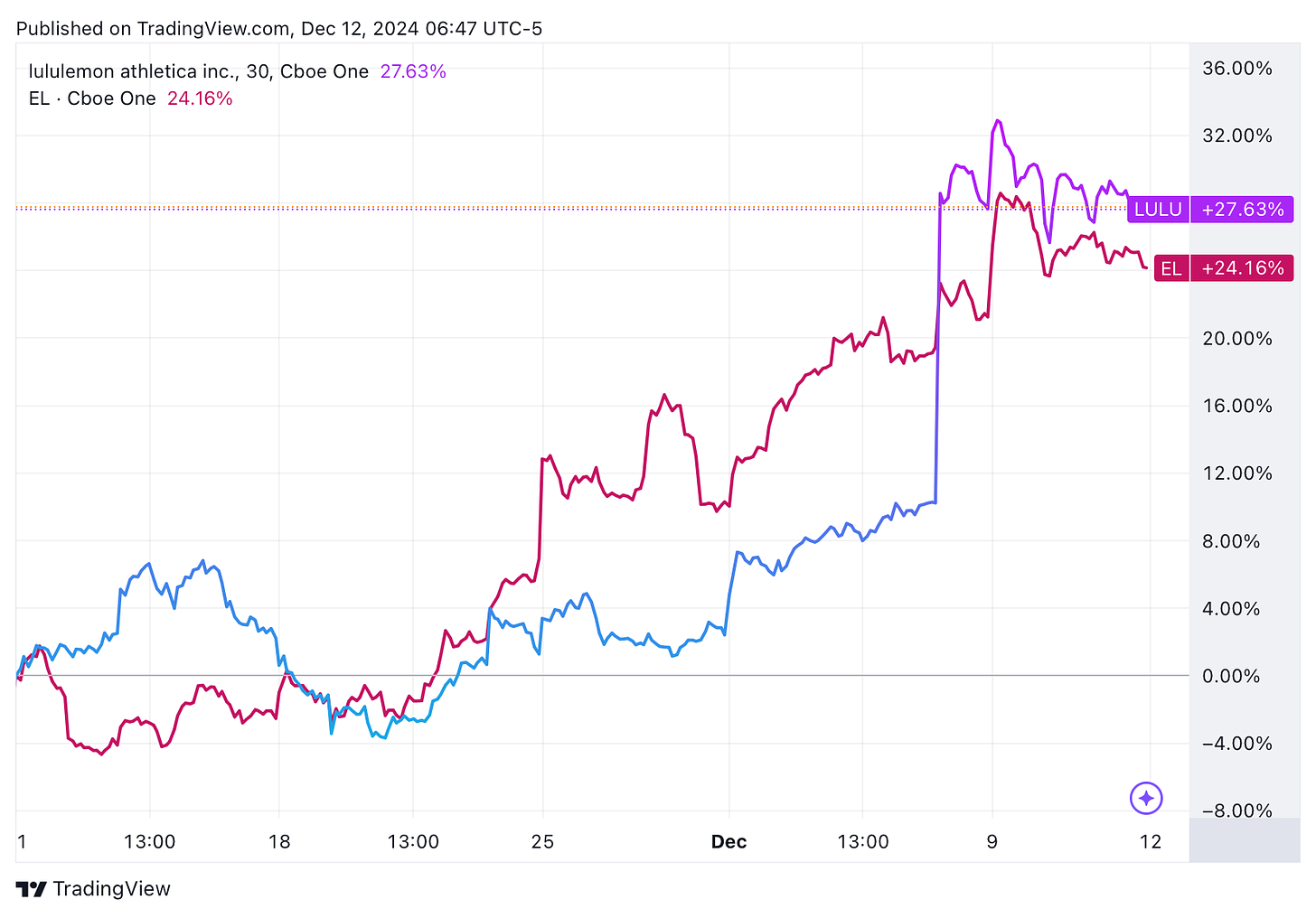

Both stocks have had a rough year but late July appears to have formed a bottom for LULU, which is up some 27% since while EL has continued to take on water:

The last month has been much better for both names:

Who knows, maybe both have now found their bottom? Unfortunately these are both (EL especially) proxies for the Chinese consumer, which is why The Contrarian was uninterested in getting involved last time.

Full disclosure: The Contrarian does have a position in EL due to poor decision-making on his part. He plans to jettison it as soon as it recovers its losses.

Housekeeping

Obviously this is not investment advice (duh). Do your own research, make your own decisions.

Read this month’s portfolio update letter here. The Substack chat tracks The Contrarian’s trades in (almost) real time.

If this daily thing is drowning your inbox and/or you CBF to bother with it and prefer to just get the guest feature or actionable highlights — you can control these settings on your account page.

Finally, if you enjoy this and want others to experience it, please gift a subscription to your friends (or even your enemies).

Share this post