Good morning contrarians!

Stock markets initially took yesterday’s hotter-than-expected inflation reading in stride, exactly as was predicted in this space. After a brief sell-off after the open, stocks even turned green for a bit.

Then however, a certain St. Louis Fed president aired comments supporting more drastic measures to rein in inflation, including a full percentage point rate hike by July. Risk assets immediately turned over on this news and the selling lasted into the close. When it was all done the Nasdaq gave up more than 2% with the S&P 500 down 1.8%. The reaction was far more dramatic in bond markets, as the 2-year yield spiked by 25 basis points for its biggest move since 2009.

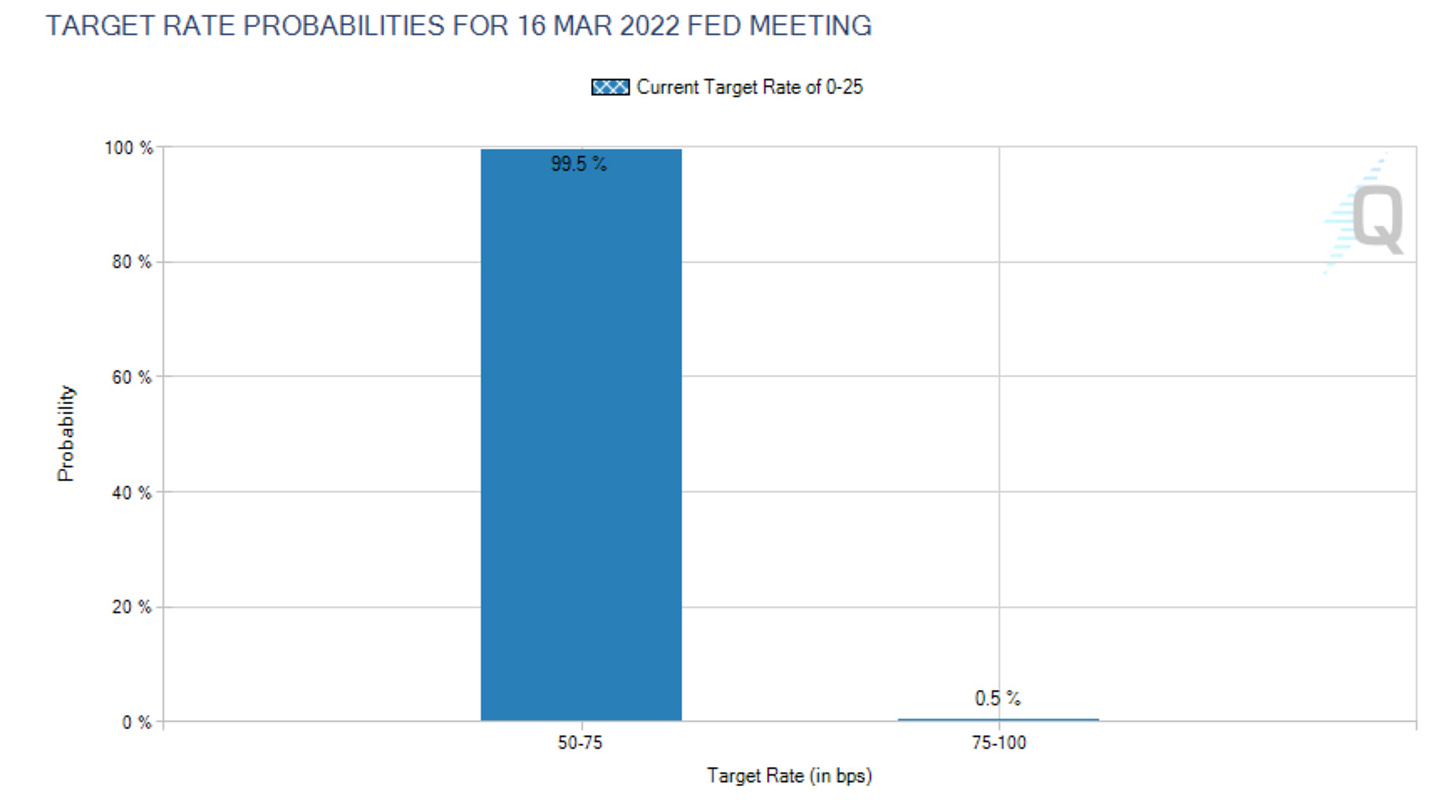

Markets are now facing serious rate hike fears for the first time in a generation. The Fed hasn’t hiked interest rates by more than 0.25% in one sitting since 2000, but that’s exactly what investors expect the central bank to do at its meeting next month. In fact, Fed fund futures are pointing to a 99.5% chance (not a typo) that the Fed hikes by 50 bps!

The Fed doesn’t have to wait until the meeting of course. They could announce a rate hike at any time. There’s quite a bit of speculation they do just that. This all brings concerns that the Fed will overreact and overdo it with tightening measures. Indeed that has been the pattern: the Fed tightens too much, markets melt down. The Fed loosens too much, creating asset bubbles. The Fed tightens in an attempt to correct its mistake that was itself an overreaction to a previous misstep. Rinse and repeat.

State of Play

Faced with that probability it makes sense for risk assets to be pointing to further sell-offs. But let’s start with bonds.

The short end of the curve is continuing to sell off, with the yield on the 2-year back up to 1.60%. It went as high as 1.64% yesterday before rebounding a bit and is now being sold again. The 10-year is holding at 2.07%. That’s also significantly higher than where it was yesterday, when it was at 1.93%.

Stock futures are dropping but not precipitously so. The Nasdaq is leading the drop so far, down 0.7%. Dow Industrials and S&P down about 0.5% with the Russell 2000 that tracks small caps down about 0.3%.

Commodities aren’t doing all that much. WTI crude is rebounding a bit, up about 1% to trade close to $91/barrel. Natural gas is up 1% to broach $4 again. Cryptos are down a bit with bitcoin about 3% lower to around $43,400.

Today’s Data

The Michigan Consumer Sentiment reading for February is out at 1000. This is the preliminary reading that would normally have people’s attention. But in light of all this Fed stuff, who cares really? For what it’s worth, economists expect the reading to come in at 67.5 compared to 67.2 seen last month.

Earnings

A couple here to tell you about. Newell Brands (NWL) and Under Armour (UAA), Dominion Energy (D), and Goodyear Tire & Rubber (GT) all report before the open.

The Bottom Line

So much for the premise that the Fed couldn’t spook markets anymore. It clearly still can and all it took were some well-timed comments by James Bullard. There are still reasons to believe the Fed will not turn out to be quite as hawkish as feared: For one, Powell is maybe still marked by the last time he raised interest rates, to only quickly reverse when the market got away from him. For another, most of the FOMC is made up of doves. But that is little comfort at this time.

Don’t fight the tape. The last time there was a 50bps rate hike, in September 2000, it put the final nail in the coffin of the dot-com boom. One would think this does not portend good things for tech stocks right now. It would take a very brave (or contrarian?) investor to go long tech today. But hey, maybe that’s the opportunity? You tell me. I’m not touching it with a 10-foot pole. Unless it gets really cheap…

The solace is that stocks and bonds can’t sell off together for very long. At some point investors need to put cash to work, especially with the rate of inflation what it is. Presumably value stocks and consumer staples would be a good place to go. That’s exactly what happened in late 2000…

Share this post