Good morning contrarians! Welcome to the Daily Contrarian, our morning look at events likely to move markets. It is Monday, June 16, 2025.

State of Play

A return to normalcy appears to be on deck, judging by or board of indicators. As of 0755 ET these are pointing to risk-on:

Stock index futures are rising, led by small caps. The Russell 2000 is up 1.1% with S&P 500 and Nasdaq both 0.6% to the good;

Commodities have returned to earth. WTI crude oil is down 1% to trade around $70.50/barrel. Copper is effectively unchanged. Gold and silver down just 0.5%;

Cryptos are rallying. Bitcoin is up <2% to trade close to $107,000 again;

Bonds are unchanged. The 10-year yields 4.44%.

Known Events to Watch

The New York Empire State Manufacturing Index, at 0830 ET, is the only economic data release of note and it’s by no means a major indicator. There is an economist survey, which is for a decline of 5.9. That’s actually an improvement over the -9.2 recorded last month.

Tomorrow we get retail sales and industrial production. Wednesday is Fed Day, with the Fed widely expected to hold rates steady. Markets are closed Thursday for Juneteenth. Friday brings earnings from Kroger (KR 0.00%↑), Accenture (ACN 0.00%↑), Darden Restaurants (DRI 0.00%↑), and CarMax (KMX 0.00%↑)

The Bottom Line

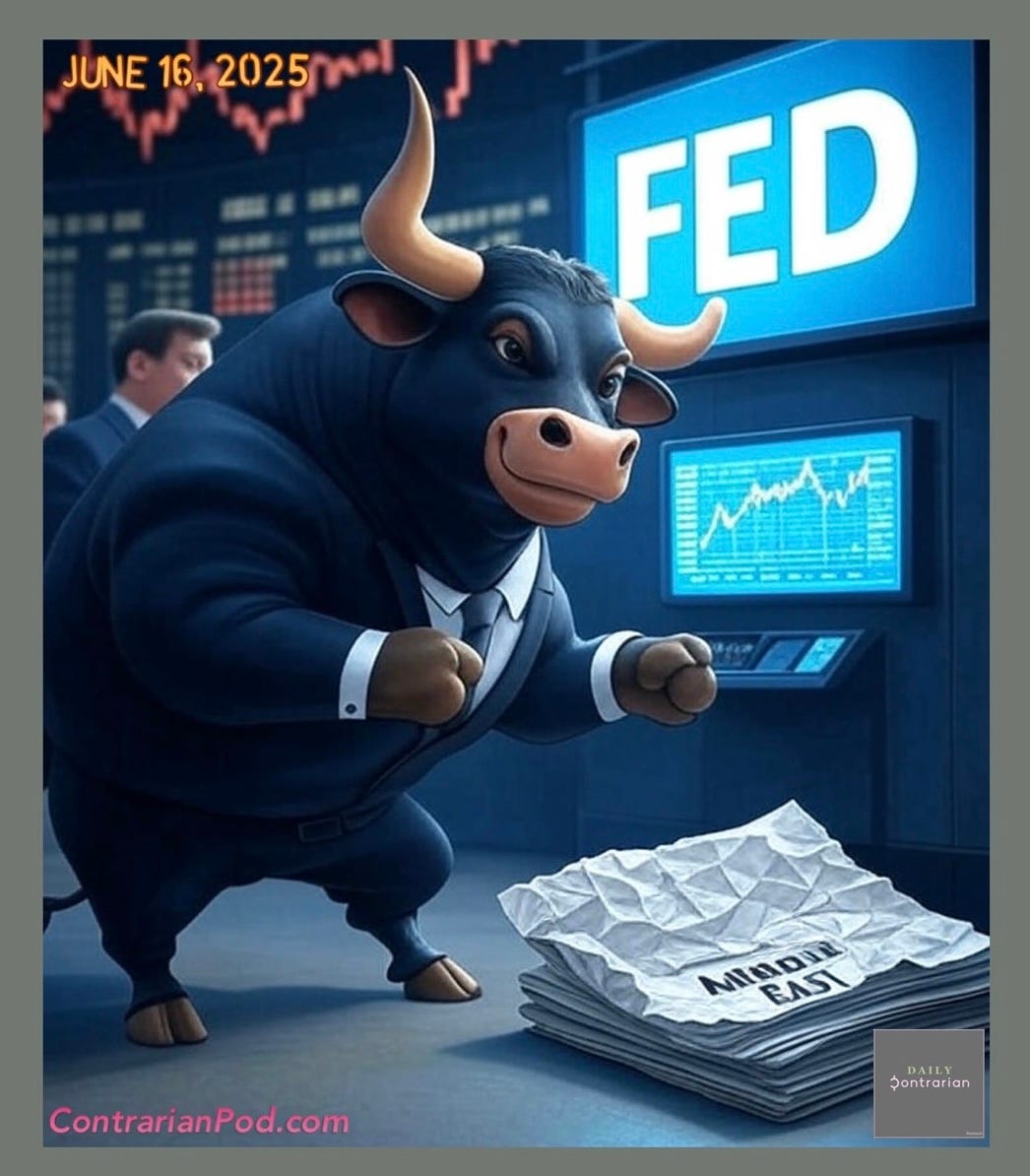

We told you on Friday that markets were already poised to brush off the Iran-Israel stuff, with oil the only real mover. And here we are, with stocks and cryptos recovering and oil dropping to below where it was before the Israeli air strikes.

There could be another shoe to drop in the Middle East of course, but that’s not how investors are playing this right now. This means the catalyst for the week will likely be the Fed on Wednesday. Investors will be looking for an indication, any indication, that the Fed is willing to cut rates. If we get that then markets should rally. If not, then it may not matter much in the whole scheme of things judging by how willing investors are to shrug off unwelcome news.

Things should otherwise be quiet. Summer is effectively here, even if the calendar doesn’t officially turn for a few more days. That means lower trading volumes. With that in mind, The Contrarian will likely not return until Wednesday, to preview the Fed. Unless something unexpected happens of course.

Housekeeping

PSA: The scheduling of this briefing is being reshuffled a bit due to the success of the live video. This will air closer to the market open, typically between 0800 and 0900 ET. Free subscribers can join live. The recording will be available to premium subscribers.

Obviously this is not investment advice (duh). Do your own research, make your own decisions.

Read this month’s portfolio update letter here. The Substack chat tracks The Contrarian’s trades in (almost) real time.

If this daily thing is drowning your inbox and/or you CBF to bother with it and prefer to just get the guest feature or actionable highlights — you can control these settings on your account page.

Finally, if you enjoy this and want others to experience it, please gift a subscription to your friends (or even your enemies).

Share this post