Good morning contrarians! Welcome to the Daily Contrarian, our morning look at events likely to move markets. It is Monday, July 7, 2025. Today’s Stock On The Contrarian Radar features Tesla (TSLA 0.00%↑) and can be read at the bottom of this page.

State of Play

B, with President Trump threatening new tariffs on countries that side with policies by BRICS nations. That is weighing on things as we eye or board of indicators for signs of direction at 0830 ET:

Stock index futures are down but off of the lows. Small caps are seeing the worst of it with the Russell 2000 down 0.5%. S&P 500 and Nasdaq are down about 0.3% each;

Bonds are seeing a bit of selling as well. The 10-year yield is up 4 basis points to 4.36% (yields move inversely to prices);

Commodities are mixed. WTI crude oil is up 0.7% to trade around $67/barrel but copper is down 0.5%. Gold and silver are dropping as well, perhaps an indication the market isn’t taking this latest tariff stuff very seriously. Both are down 1-1.5%;

Cryptos are unchanged. Bitcoin is up 0.5% to trade around $108,600.

Known Events

It’s a pretty slow day. Make that a slow week. Nothing of note on the calendar today. Tomorrow brings consumer credit. Wednesday a 10-year note auction and FOMC minutes from the last meeting. Thursday a few earnings and a couple of Fed speakers. Friday the WASDE Report.

So yeah, slow week

The Bottom Line

With nothing else going on the focus will be on tariffs. So far this is mostly noise, as evidenced by futures though it is enough to chill some of the good cheer we got with non-farm payrolls on Thursday.

This leaves us with a cautious start to the week. We may be in a holding pattern until FOMC meeting minutes on Wednesday, unless of course there is fresh tariff news to drop.

On the topic of the Fed, investors don’t seem concerned with all the noise Trump is making about removing Jerome Powell and replacing him with somebody who will cut interest rates. The questions this raises about the Fed’s independence are obvious. Perhaps investors figure nothing will happen until Powell’s term expires next May and when it does the Fed will already be on a rate-cutting course. And that Trump will leave offices some 20 months after that. Either way, it’s not something that seems to factor into risk calculations very much.

Stock On The Contrarian Radar©️

Tesla (TSLA 0.00%↑) is down 6% in the pre-market at the time of this writing after Elon Musk, who has apparently never hear of Ross Perot, said he is launching a political party. Buying opportunity for Tesla? This morning’s move drops the stock below $300 again:

As you can see, this is still a ways off of the lows of the year. TSLA is a crazy stock due to wild swings resulting from any number of factors. Ultimately the stock is priced for its potential in all things electric vehicles, self-driving cars, and more. For this reason it is the rare example where fundamentals really don’t apply. But other things do.

A lot of these have to do with Elon Musk himself. Investors clearly want Musk to not only be part of Tesla, but make it his primary focus. If he is starting a political party that obviously means less time spent on Tesla. And that is why the stock is dropping so dramatically this morning.

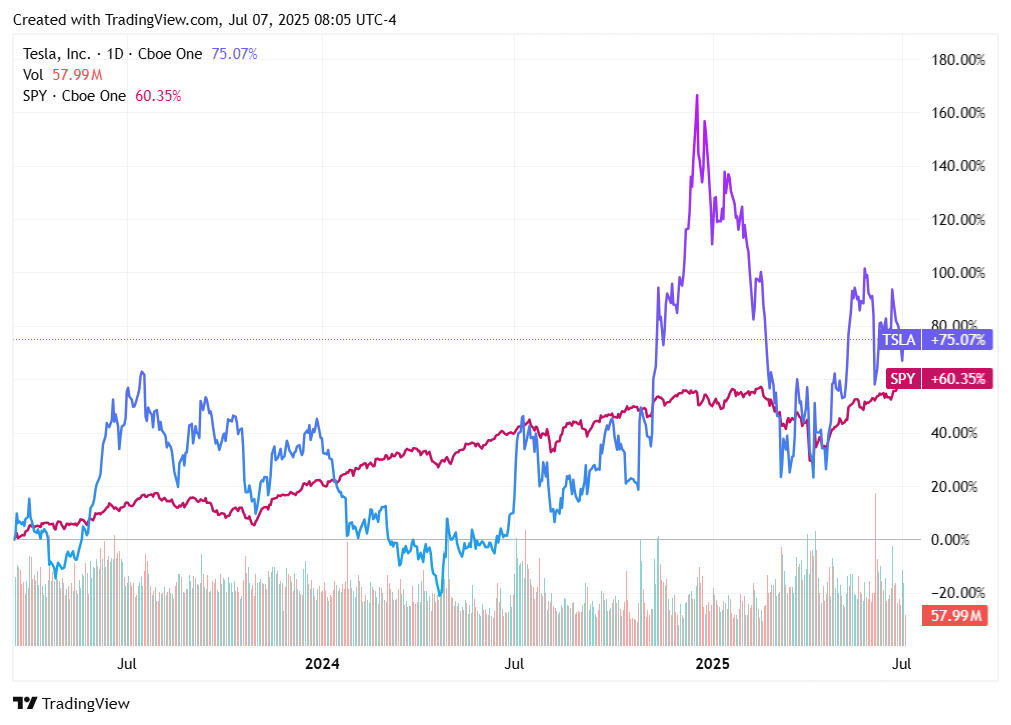

An interesting exercise is to hold TSLA up against the S&P 500 (SPY 0.00%↑ ):

Over the last two years or so, Tesla has kind of tracked the SPY albeit with much more volatility. Worth noting the period in late 2024 when TSLA trounced the SPY, presumably due to Musk’s involvement with the Trump administration and the benefits this was believed to bring for the stock. If you remove that outlier, the traction is much more solid.

In the past two years it has paid to buy TSLA when it dipped below the S&P’s return dating to the early 2023 start date. This was most recently in May. As the above chart indicates, TSLA is now close to the S&P but not close enough where it has (historically) presented a buying opportunity.

The Verdict

For this reason The Contrarian is not buying this dip in Tesla though he is monitoring the situation closely. If TSLA dips to the $250/share range it may make sense for The Contrarian to buy a few shares.

Full disclosure: The Contrarian has never owned TSLA outright though it is obviously included in several indexes he owns in retirement accounts.

Not investment advice! Do your own research, make your own decisions.

Housekeeping

PSA: The scheduling of this briefing is being reshuffled a bit due to the success of the live video. This will air closer to the market open, typically between 0800 and 0900 ET. Free subscribers can join live. The recording will be available to premium subscribers.

Read this month’s portfolio update letter here. The Substack chat tracks The Contrarian’s trades in (almost) real time.

If this daily thing is drowning your inbox and/or you CBF to bother with it and prefer to just get the guest feature or actionable highlights — you can control these settings on your account page.

Finally, if you enjoy this and want others to experience it, please gift a subscription to your friends (or even your enemies).

Share this post