Good morning contrarians! Welcome to the Daily Contrarian, our morning look at the upcoming known events likely to move markets in the day ahead. Today is Thursday, June 15.

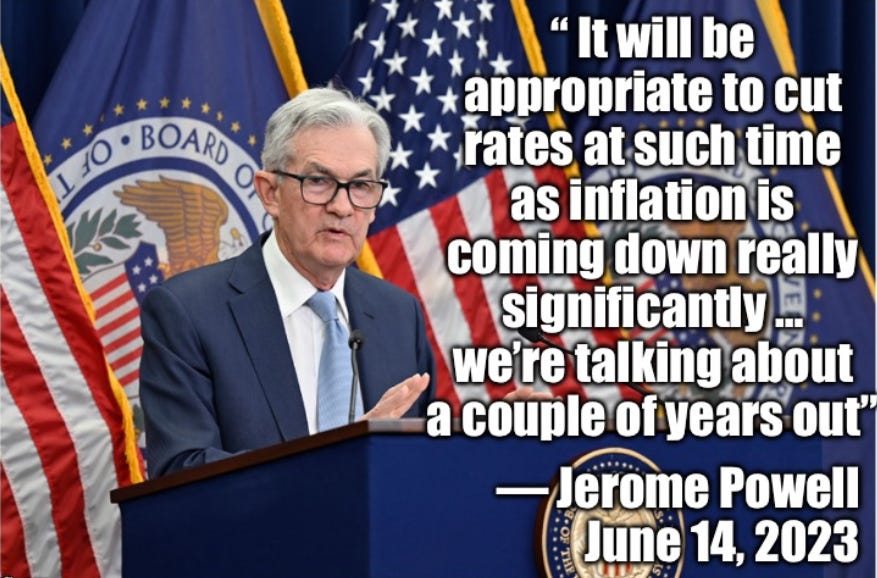

The Fed yesterday stood pat as expected, leaving its key interest rate unchanged. It’s seen as a ‘hawkish pause’ though, because of implications there will be two more rate hikes this year. Where the prospect of rate cuts are concerned — that elusive Fed pivot — Jerome Powell again said these weren’t happening, in fact for “a couple of years.”

State of Play

The market mostly shrugged off yesterday’s interest rate decision. There was a small reversal to risk-off, and bonds sold off a bit as well, but nothing terribly significant. As of 0620 this morning it looks like the bearishness could prevail:

Stock index futures are down a bit, led by tech. The Nasdaq is pointing to a drop of 0.7% at the open. The S&P 500 is down 0.4%;

Commodities are mixed. WTI crude oil is up 1% to trade around $69/barrel again, but gold is down 1%, silver is down 2.5%, and copper is flat. The move in precious metals makes some sense as a reaction to a hawkish Fed because interest rate hikes are good for the US dollar and bad for USD hedges;

Cryptos are down a bit this morning, with Bitcoin dropping 4% to trade below $25,000. Presumably for the same as the gold/silver trade;

Bonds are continuing to sell off a bit, with the 2-year yield up 3 basis points to 4.73% and the 10-year up 2bps to 3.82%.

Listen to this episode with a 7-day free trial

Subscribe to Contrarian Investor Premium to listen to this post and get 7 days of free access to the full post archives.