Good morning contrarians! Welcome to the Daily Contrarian, our morning look at events likely to move markets. It is Tuesday, Sept. 10. The Bottom Line segment of today’s podcast starts at (2:41) and Stocks on the Contrarian Radar©️ at (4:41) for listeners who want to skip ahead.

State of Play

Stocks advanced yesterday on no news with S&P 500 and Nasdaq advancing more than 1% each. Good news from Oracle (ORCL 0.00%↑) earnings after the close has that stock up 9% overnight. As we eye our board of indicators for signs of direction at 0655 there isn’t much to go by quite yet:

Stock index futures are down a bit, with small caps off 0.4% judging by the Russell 2000. Nasdaq futures are down 0.2%. S&P futures thus far unchanged;

Commodities are retreating a bit with WTI crude oil down 1% to trade around $68/barrel and copper down 0.4%;

Cryptos are gaining ground however, with Bitcoin up 3% to trade north of $57,000;

Bonds aren’t doing anything. The yield curve remains uninverted, with the 2-year yielding 3.69% and the 10-year 3.72%.

Today’s Known Events

China trade balance came in a little higher than anticipated thanks to exports increasing more than had been expected — typically a good sign for the global economy.

There’s nothing on the calendar today other than a few earnings of interest, all of them after the close: GameStop (GME 0.00%↑), Dave & Buster’s (PLAY 0.00%↑), and Petco Health & Wellness (WOOF 0.00%↑).

The Bottom Line

With so little — okay, nothing — on the calendar it’s a good opportunity to take the pulse of investors’ base emotions. Judging by yesterday’s activity, this would appear to be one of greed versus the fear that we saw last week.

Today could be a different story, but it shouldn’t just because we haven’t gotten any new information other than Oracle earnings and China’s trade balance, and that was positive.

Stocks on the Contrarian Radar©️

AI chip names like Nvidia (NVDA 0.00%↑), Arm (ARM 0.00%↑), and Super Micro Computer (SMCI 0.00%↑) were among yesterday’s big gainers:

Nice rebound, but these stocks are still down pretty big over the last five trading days, to the tune of almost 8% in SMCI’s case:

This all begs the question of course if this is just a dead-cat bounce or if the rally has staying power. If so, you figure it would extend to our ‘undiscovered’ AI chip names as well, right?

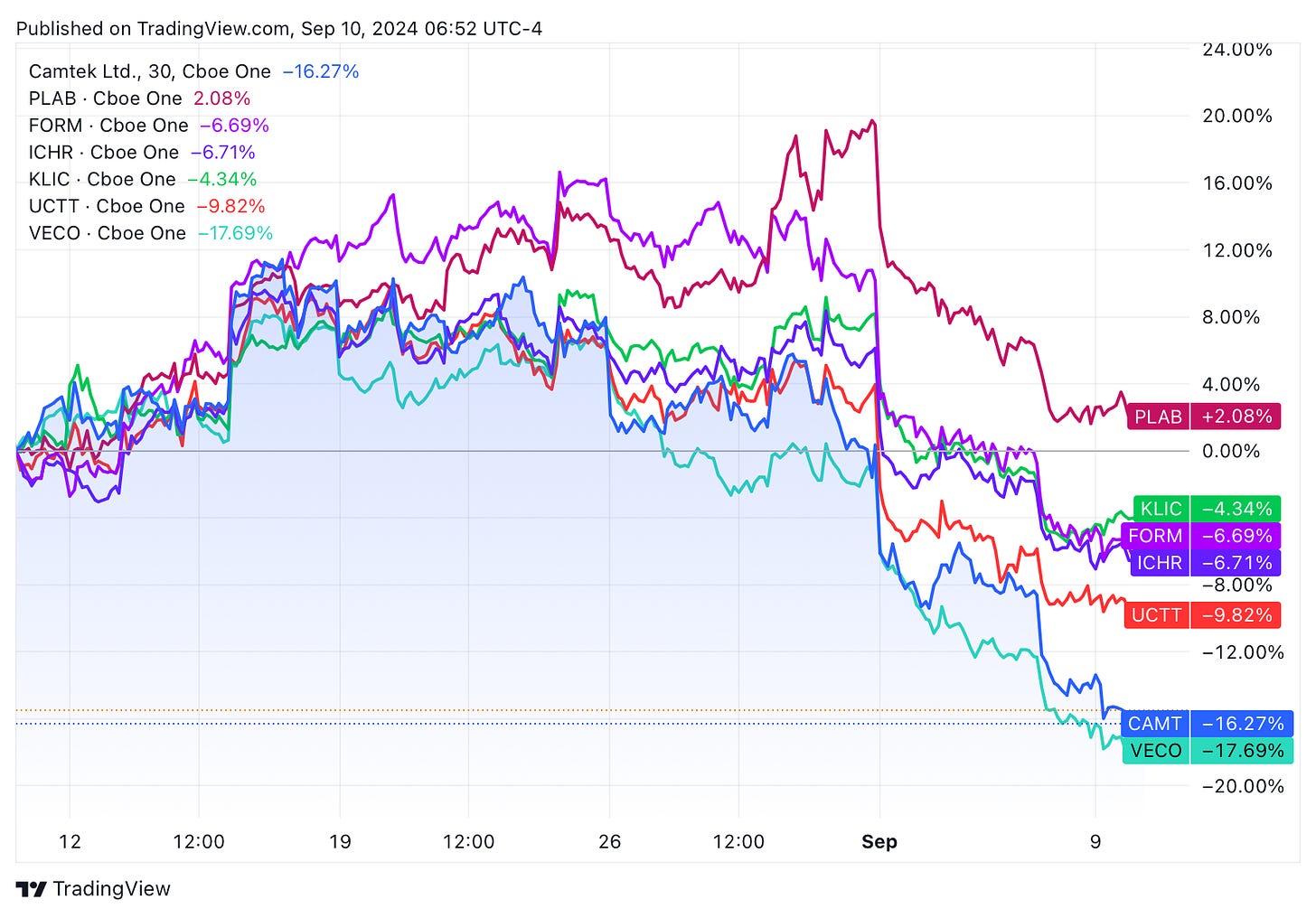

The damage here has been pretty bad over the past month, though our friend Photronics (PLAB 0.00%↑) is somehow still positive over that period:

The point is that there is still a long way to go for all of these stocks (ex-PLAB) to recapture their levels of even a week ago. If the tech sector — and broader market — is rebounding, then it stands to reason that there is upside in these names.

Of course if this is all a dead-cat bounce/fake-out rally then maybe this is just an opportunity to short at better prices. You tell me.

Full disclosure: The Contrarian is long CAMT and PLAB and therefore has a vested interest in seeing these stocks move higher. This may have — and probably did — cloud his judgment.

Housekeeping

Obviously this is not investment advice (duh). Do your own research, make your own decisions.

This Substack chat tracks The Contrarian’s trades in (almost) real time.

If this daily thing is drowning your inbox and/or you CBF to bother with it and prefer to just get the guest feature or actionable highlights — you can control these settings on your account page.

Finally, if you enjoy this and want others to experience it, please gift a subscription to your friends (or even your enemies).

Share this post