Good morning contrarians! Welcome to the Daily Contrarian, our morning look at events likely to move markets. It is Monday, Sept. 9. The Bottom Line segment of today’s podcast starts at (3:30) and Stocks on the Contrarian Radar©️at (6:48) for listeners who want to skip ahead.

State of Play

Stocks dropped again on Friday, with tech seeing the worst of it. As we eye our board of indicators for signs of direction at 0650, that seems to be long forgotten and risk-on appears to be in the offing:

Stock index futures are pointing to gains, led by tech. The Nasdaq is up 0.8% with S&P 500 futures right behind it;

Commodities are showing some signs of life as well, with copper up 1.7%. WTI crude oil up 0.5% to trade north of $68/barrel (still the lower end of the range it has been in the last months);

Bonds are dropping just a bit in keeping with the risk-on theme. The 2-year yield is up 5 basis points to 3.70% and the 10-year is up 5bps to 3.75% (yields move inversely to prices. Yes, the yield curve has uninverted!

Cryptos are effectively unchanged with Bitcoin up 1.5% to trade around $55,400.

Today’s Known Events

It’s a pretty quiet start of a pretty quiet week.

US Consumer Credit is out at 1500 this afternoon. Economists who were surveyed expect this figure to come in at $12.5 billion, a marked increase from the $8.9 billion recorded last month. That would place consumer credit at the highest level since March. But that doesn’t tell the whole story. US consumers taking on debt is not necessarily a bad thing because that means they can continue to buy stuff (they don’t need). Until, of course, it becomes too burdensome to service the debt and they are forced to scale back on spending.

On this topic, the Wall Street Journal had an interesting story yesterday about the state of Americans’ finances more generally. The TLDR of it is that Americans “have more money in the bank than they did in 2019, even after adjusting for inflation and just slightly less credit-card debt relative to income.”

One earnings report to tell you about. Oracle (ORCL 0.00%↑) reports after the close this afternoon.

The Bottom Line

Last week was the worst one of the year for stocks. It looks now like we could get a little bit of a relief rally. Copper is particularly encouraging here. We often talk about how futures are a ‘head fake’ for what transpires during the regular session. Somebody should do a study holding this up to how copper futures trade in the pre-market. One suspects that if copper futures are up over 1% as they are today, the buying will persist through the regular session — unless of course acted on by an outside force such as news or new data.

News is always a wild card of course but we aren’t getting much in terms of new data this week. You’ll likely hear a lot about Wednesday’s CPI report but inflation is no longer the focal point it once was. The inflation dragon has effectively been slayed and the only question is if economic growth can continue or if it will fall off a cliff and enter recessionary territory. For that we have to look to the labor market. All we have there are initial jobless claims on Thursday.

Stocks on the Contrarian Radar©️

Insurance company Lowe’s (L 0.00%↑), not to be confused with the retailer Lowe’s (LOW 0.00%↑), is down almost 8% overnight. It’s not exactly clear what is causing this. A rudimentary Google search unveiled a bunch of stuff about the actor Rob Lowe.

Isn’t insurance Warren Buffett’s favorite business? A quick look at the year-to-date chart unveils this sell-off actually started last week, but is just a drop from the high-water mark of the year:

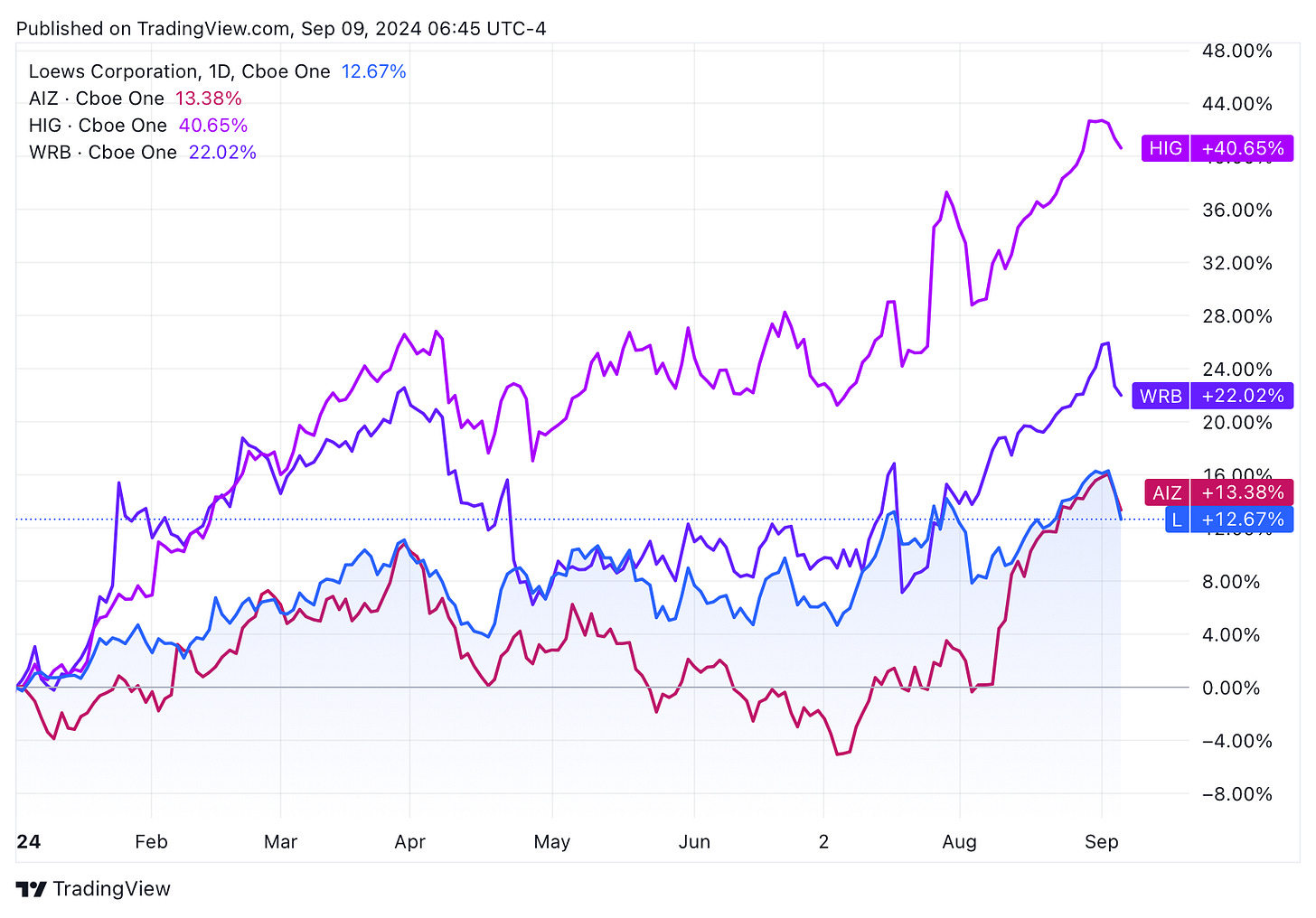

The stock trades at <12x earnings, 1x sales, and 6x cash flows, which would appear to make it cheap. Of course, you have to hold it up to peers’ performance as well. Most cited are The Hartford (HIG 0.00%↑), Assurant (AIZ 0.00%↑), and W.R. Berkeley (WRB 0.00%↑), and you can clearly see that L has underperformed them YTD. Indeed all appear to have tracked Lowe’s downward this last week:

Meanwhile, who knew it had been such a great year for insurance stocks? That type of thing does not make The Contrarian particularly bullish about the sector, or about Lowe’s specifically, even after this sell-off. But it’s something to look at, especially if/when defensive sectors gain favor due to fear-based selling…

Disclosure: The Contrarian does not have a position in L or any of the other insurance stocks mentioned here.

Housekeeping

Obviously this is not investment advice (duh). Do your own research, make your own decisions.

This Substack chat tracks The Contrarian’s trades in (almost) real time.

If this daily thing is drowning your inbox and/or you CBF to bother with it and prefer to just get the guest feature or actionable highlights — you can control these settings on your account page.

Finally, if you enjoy this and want others to experience it, please gift a subscription to your friends (or even your enemies).

Share this post