Good morning contrarians! It is Tuesday, Sept. 13. Inflation day, with the CPI due out at 0830.

Stocks advanced yesterday for the fourth day in a row. The Nasdaq led things again, adding 1.3%. The S&P 500 was up 1.1%. Again no obvious catalyst for the move higher, other than maybe oversold conditions and optimism over Ukrainian advances versus Russia.

State of Play

As of 0610, all is pretty quiet ahead of the CPI:

Stock futures are moving higher, with the S&P and Russell 2000 up 0.4% and Nasdaq up a little less;

Commodities are gaining ground, with WTI crude oil up 1% to trade close to $89/barrel. Silver is down for the first time in awhile, by 0.4%;

Cryptos are flat-ish, with Bitcoin up 1% to trade around $22,400;

Bonds are seeing a few bids, with the 2-year up 4 basis points to 3.53% and the 10-year up 4bps to 3.32% (yields move inversely to prices).

Consumer Price Index

August CPI is out at 0830. Economists expect a negative month-over-month print, -0.1% to be exact, following last month’s flat MoM reading. The year-over-year figure is expected to come in at 8.1%.

The core CPI, which excludes food and energy, is expected to print at 0.3% MoM and 6.1% YoY. Last month these figures were 0.3% and 5.9%.

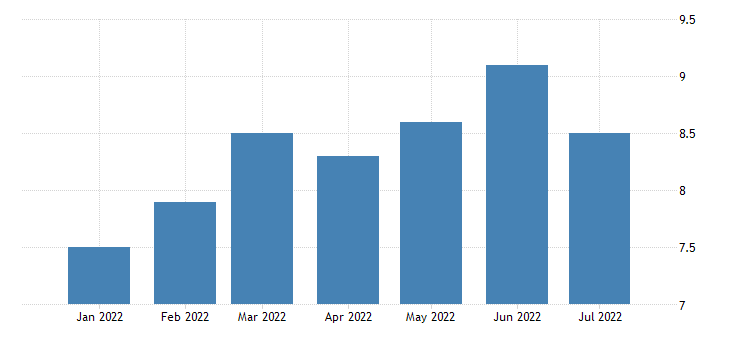

From the chart, it looks like inflation has indeed peaked. Today’s report could drive that home, with YoY numbers not seen since February:

The Twitter account @Gurgavin was kind enough to compile all the Wall Street estimates for you. As you can see, these range from 7.9% to 8.3% for the YoY CPI. Of course, our very own guest on last night’s bonus episode is toward the lower part of this range.

CPI & the FED

Jerome Powell’s Jackson Hole speech made it very clear that the Fed is determined to raise interest rates to tame inflation, even if that comes at the expense of economic growth. That was a shock to the market, which was (erroneously, it turns out) anticipating a ‘pivot’ to neutral interest rates.

Since then, the speculation has turned to exactly how much longer the Fed is going to be forced to carry out this hawkish policy. The answer lies in how persistent inflation is over coming months. We’ll get our first clue of this today.

The Bottom Line©

A soft CPI number (below 8.1% YoY for headline, 6.1% for core) will potentially remove some pressure on the Fed, which in turn will give investors reason to keep bidding up risk assets. Anything north of that and we should see selling; not just in risk assets, but also bonds. Either way, it’s likely the Fed is set to raise another 0.75% at its meeting next week, if only to shore up its credibility.

Lost in all this is the fact that the Fed’s rate hikes have not really had any effect yet outside of the mortgage market. Indeed, it may be some time before those hikes are reflected in the job numbers and in consumer data. Meanwhile, 8% inflation is still awfully high, not to mention a long distance from the Fed’s 2% target. So there is a very real risk the Fed becomes impatient and ends up overdoing the rate hikes. That could cause all kinds of problems. Look at 2007 for example.

Obviously that is the worst case scenario. The best case is that the Fed is able to engineer a soft landing. Ultimately these are both extremes: the Fed very rarely pulls off a soft landing and 2007 was a generational event with a housing bubble of historic proportions. It’s likely that our outcome will fall somewhere between these two extremes. Where and when remain the open questions.

Share this post