Good morning contrarians!

Stock futures are not doing much as of 0630. Tech is down a bit, with the Nasdaq pointing to a loss of 0.3% at the open. S&P 500 futures are flat and Dow Industrials are up about 0.2%.

Bonds are flat. The 10-year yield is trading around 3% whilst the 2-year is at 2.86%, both roughly unchanged. Commodities aren’t doing much either. WTI crude oil is up about 0.5% to trade around $122/barrel.

Cryptos are dropping a bit with bitcoin down 1.6% to trade below the $30,000 level again.

Economic Data Releases

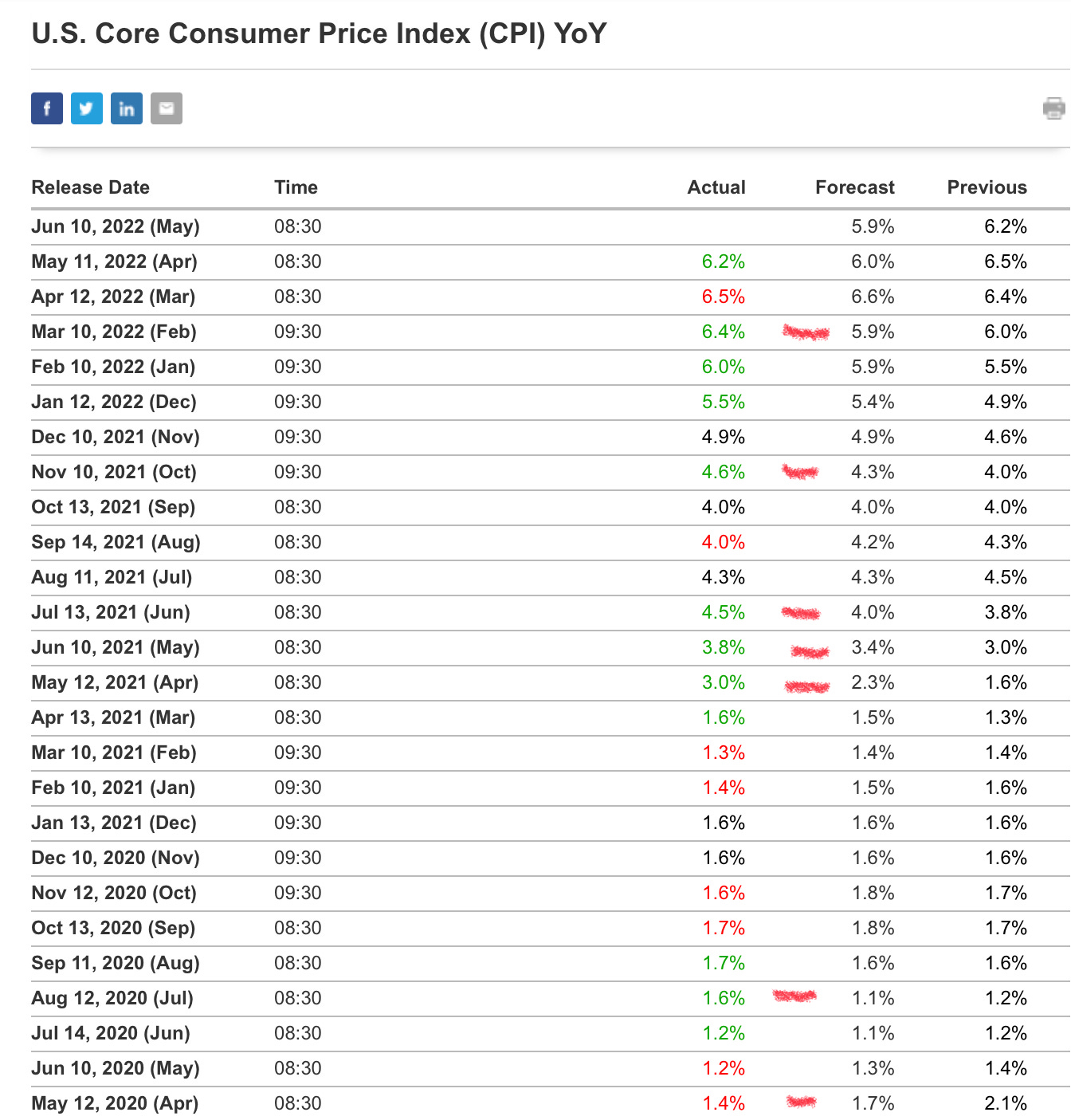

The U.S. Bureau of Labor Statistics reports Consumer Price Index figures for May at 0830. The important figures here are the year-over-year percentage gains for CPI and core CPI (excluding food and energy costs). The consensus estimates are for 8.3% for thee CPI and 5.9% for the core CPI. Last month those were 8.3% and 6.2%, respectively.

It bears noting that the consensus estimates are what matter to markets. There is going to be a lot of Sturm und Drang (German term loosely translated as mad drama) around inflation today regardless. These news stories around “inflation near 40-year highs” have likely already been written, with just the numbers left to fill in. The point is not to inform but to shock in an attempt to get clicks. Don’t fall for it. The survey numbers are what matters and YoY is the most important. Again these are 8.3% and 5.9% for headline and core CPI, respectively.

As repeatedly noted in this space, economists are actually pretty good at predicting the CPI. As you can see from this table, the last two years there have been just six instances where their estimates missed by 0.3 percentage points or more for the core CPI (the six events are marked by red lines).

Three of those six misses came last spring when stimulus checks led to a spike in spending (and therefore prices). A fourth was after the Russian invasion of Ukraine. So it’s safe to say that without major external shocks, most of these estimates are bang on the money or extremely close.

Investors know this, so any deviance from the estimate will likely lead to a violent reaction in markets today. This is especially true if the number somehow exceeds estimates. We’ve been hearing about ‘peak inflation’ for awhile and indeed the numbers have (so far) born this out.

But we have just one month of declines from this supposed peak in March. Personal Consumption Expenditures, the Fed’s preferred inflation gauge, peaked a month earlier and now has two straight months of declines, so there is that (but we don’t have PCE data for May yet. The CPI is the first one to supply May data).

We also have the University of Michigan’s preliminary Consumer Sentiment reading, at 1000. There are two of these each month and this is the first, more important preliminary one. The consensus is for a reading of 58.0, slightly below last month’s 58.4. There are other metrics in here and a bunch of commentary about what consumers are saying. So this is an important report but one that will likely be overshadowed by the CPI.

The Bottom Line

Could the CPI spike higher in May? You better hope not, because it would surely lead to quite dramatic selling. For one, a print of 6.3% for core CPI would be more than 30bps away from economist estimates and therefore an uncharacteristic miss. There haven’t been any major external shocks that immediately come to mind, so economists have no excuse.

More importantly, stubbornly high inflation will force the Fed to keep its foot on the gas pedal where interest rate hikes are concerned. That will make borrowing more expensive, which will crimp economic activity. Almost all recessions start with this kind of removal of liquidity. That’s why investors have been nervous since the Fed started tightening — which was in response to higher inflation (after the Fed spent a summer insisting it was ‘transitory’ but whatever).

And that is why these inflation readings are so important. Many investors appear to be holding out hope that the U.S. economy can have a ‘soft landing’ and avoid recession. That very rarely happens when the Fed tightens like this, though there is often a lag of a year or more (see the period from 2004 through 2006 as just one example. The Fed was tightening the entire time but the economy didn’t enter recession until late 2007).

By the same token, if inflation comes in below forecasts, it will in all likelihood lead to a relief rally. The Fed will still need to hike rates in the short term, but some of the pressure will be removed for the longer term. Speaking of the short term, the FOMC meets next week to decide on interest rates. But that is all next week’s story.

Share this post