Good morning contrarians! Welcome to the Daily Contrarian, our morning look at events likely to move markets. It is Wednesday, May 15. CPI Day. The Bottom Line segment of today’s podcast starts at (3:09) for listeners who want to skip ahead. Be sure to check out the new ‘One Year Ago Today’ segment at the bottom of this page.

State of Play

Stocks advanced yesterday as investors shrugged off hotter-than-anticipated producer prices. The Nasdaq closed at a new record high. As we look at our board of indicators at 0630, things are quiet outside of Dr. Copper:

In commodities land the aforementioned copper continues to gain ground, up 3% this morning to trade at a fresh record high. Talk about producer prices. Apparently demand for electric vehicles and data centers is what’s behind this, though that explanation appears insufficient because it’s not like those things just materialized last week. WTI crude oil is unchanged at $78/barrel;

Stock index futures are dead quiet again with the exception of small caps, which are advancing a bit. The Russell 2000 is up 0.3%;

Bonds are seeing a few bids with the 2-year yield down 2 basis points to 4.80% whilst the 10-year is down 3bps to 4.42%;

Cryptos aren’t really doing much. Bitcoin is up 1.5% to trade around $62,800.

Today’s Known Events

Yesterday we had producer prices, which was summarily ignored by the market. Today we have consumer prices, which are (one would think) much less likely to be ignored.

Economists who were surveyed expect the following numbers, out at 0830:

Headline CPI of 0.4% month-over-month, the same as last month;

Headline CPI of 3.4% year-over-year, a slight decrease from the 3.5% recorded last month;

Core CPI of 0.3% MoM, a bit below what was seen last month (0.4%);

Core CPI of 3.6% YoY, also a bit below last month’s 3.8%.

If that weren’t enough, we also have retail sales out at the same time. The numbers anticipated there is an increase of 0.4% MoM, which is below the 0.7% levels from last month. Core retail sales, which exclude automobiles, is expected to come in at just 0.2% MoM, a significant drop from the 1.1% recorded last month.

No real earnings worth mentioning today. Cisco (CSCO 0.00%↑) reports after the close. That means economic data will have the floor.

The Bottom Line©️

Yesterday’s producer prices were not good at all, with monthly Core PPI coming in at 0.5% when just 0.2% was expected. This is particularly disconcerting because of how close inflation data usually prints to economist forecasts — unless there is an exogenous event like Covid stimulus or Russia invading Ukraine. There were none of these during April. The market ignored this for whatever reason, but it does raise the question of whether there will be a similar outlier on the consumer side.

Even so, Core CPI has been running hot, with three consecutive months of 0.4% increases. That doesn’t sound like a lot (and indeed is probably not even noticeable as such) but three months in a row of that adds over a full percentage point to the annualized figure. No wonder that expectations of a Fed rate cut have been pushed out.

Then you have retail sales, which is arguably even more crucial. There have been reports of the US consumer starting to roll over. So far these seem to be sensationalized news stories based on the same sources, which are earnings from Starbucks (SBUX 0.00%↑) and McDonald’s (MCD 0.00%↑). Remember that news media will do anything to push out a story that attracts clicks. Take it from somebody who knows this from having spent just about his entire career in this particular trade.

Having said that, last week’s University of Michigan Consumer Sentiment survey was the lowest reading in six months. So watch this space. Maybe stagflation isn’t as distant a prospect as we might think. Hope you listened to

on this topic:The Specter of Stagflation Still Looms: Ayesha Tariq (Szn 6, Epsd 8)

Ayesha Tariq, founder of Macro Visor, rejoins the podcast to discuss her views on the economy, markets, and where investors should look for opportunities. This episode was recorded on Tuesday, May 7 and is being made available to premium subscribers exclusively at this time. A six-minute

Last Words for Today

Be careful what you wish for. The consumer will eventually roll over. There will be layoffs. Jobs will be hard to come by. The Fed will cut rates and bonds will rally. But that set-up may not be preferable to today’s. Like, at all.

One Year Ago Today…

Debt ceiling negotiations were creating a little noise, which The Contrarian (wisely, it turns out) told readers to ignore. Drama continued with regional bank stocks (Daily Contrarian, May 15, 2023).

…and What Happened:

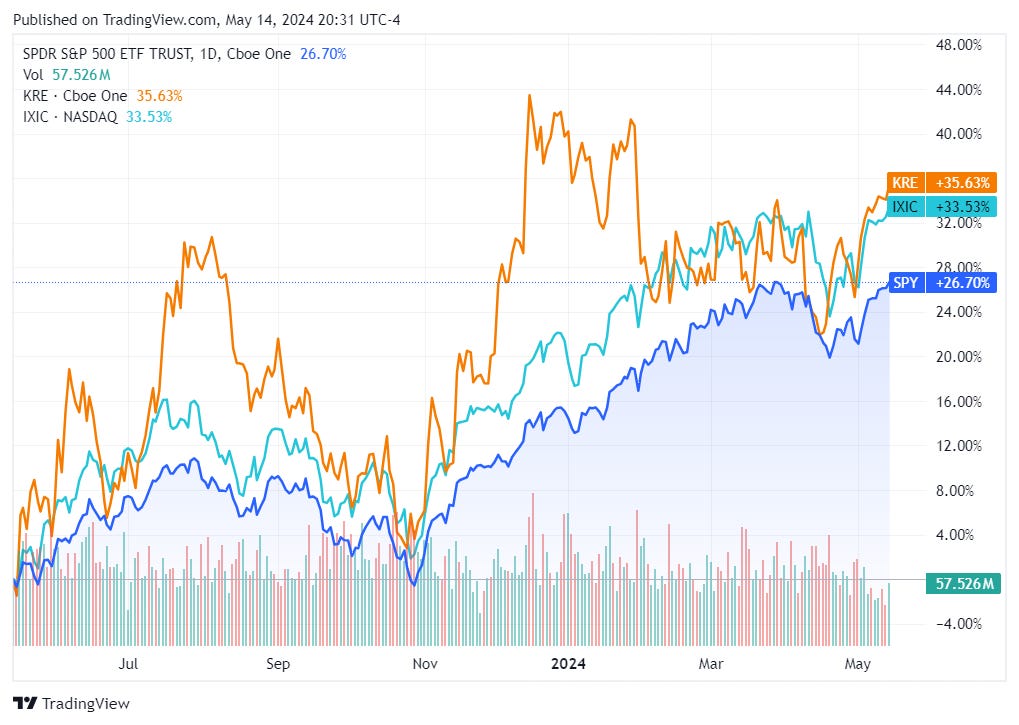

It would turn out to be a good time to buy stocks, as the chart below illustrates. Regional banks were, as a whole, the best performer — at least compared to the S&P and Nasdaq, with the KRE 0.00%↑ up 36% over the last 365 days. Of course, the same purchases could have been made in November with identical results.

Housekeeping

Obviously this is not investment advice (duh). Do your own research, make your own decisions.

Please take the new readership/listenership survey right here in Substack! You will be entered into the drawing for a free Contrarian™️ coffee mug.

This Substack chat tracks The Contrarian’s trades in (almost) real time. The full portfolio is available upon request.

If this daily thing is drowning your inbox and/or you CBF to bother with it and prefer to just get the guest feature or actionable highlights — you can control these settings on your account page.

Finally, if you enjoy this and want others to experience it, please gift a subscription to your friends (or even your enemies).

Share this post