Good morning contrarians! Welcome to the Daily Contrarian, our morning look at events likely to move markets in the day ahead. Today is Tuesday, Sept. 5. Welcome back after the Labor Day holiday.

State of Play

It’s a pretty slow week in terms of known events. Some Fed speakers the latter half of the week are probably the lone highlight. As of 0600, all is predictably pretty quiet:

Stock index futures are pointing to a lower open, with small caps leading the drop. The Russell 2000 (IWM 0.00%↑) is down 0.7%. Nasdaq (QQQ 0.00%↑) off about 0.3% and S&P 500 (SPY 0.00%↑) due to open about 0.2% lower

Commodities are lower. Natural gas prices are down about 5%. Not sure what that’s about. Dr. Copper is down 1%. WTI crude oil is unchanged at $85.50/barrel;

Bonds are seeing a little bit of selling. The 2-year yield is up 4 basis points to 4.91% whilst the 10-year is up 5bps to 4.23% (yields move inversely to prices).

Known Events

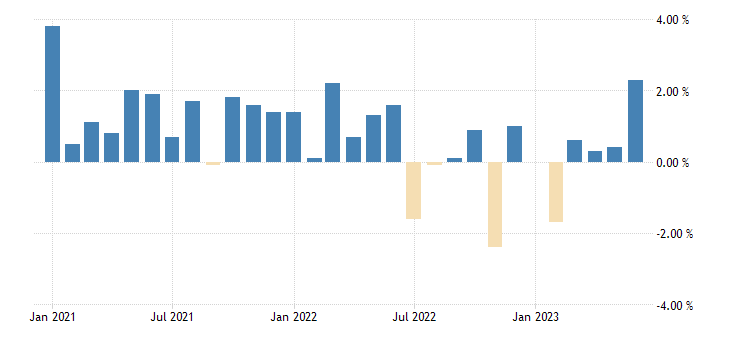

Factory orders are out at 1000. Economists surveyed expect a drop of 2.5% month-over-month compared to an increase of 2.3% MoM at the last reading. As you can see this would be one of very few negative readings these last couple of years:

Not sure how many of these times economists have actually expected a negative print, and obviously one negative print does not a trend make. Still, it will be interesting to see how this shapes up seeing how it is a pretty leading indicator. Of course, there are seasonal components at play here as well.

The Bottom Line©️

Traders will be back in the office after the holiday and could have itchy fingers so things may not be as quiet as the dearth of events on the calendar indicate. Last week we finished August on a high. September is historically the weakest month for stocks, but don’t forget that past performance is not a guide to future results.

Chances are the Fed will be the focus of the week. The FOMC start their long-awaited September meeting two weeks from today. Futures traders are now pricing in a 93% chance the Fed stands pat. That’s up from last week, presumably due to the soft-ish jobs report we got on Friday. But Fed speakers may provide more clues later in the week.

Housekeeping

Obviously this is not investment advice (duh). Do your own research, make your own decisions.

This Substack chat tracks The Contrarian’s trades in (almost) real time. The full portfolio is available upon request.

Be sure to check out our Substack notes, for more contrarian thoughts and missives throughout the day.

If this daily thing is drowning your inbox and/or you CBF to bother with it and prefer to just get the guest feature or actionable highlights — you can control these settings on your account page.

Also:

Please take the listener survey! It’s like, five questions and should only take a few minutes of your time. You can win free merchandise. A lucky respondent will be selected each month to receive a classic crew-neck T-shirt.

Referrals. The best way to support this work. Invite friends to subscribe and read/listen with us. Use this referral link:

There are benefits:

Get a 1 month comp for 3 referrals

Get a 3 month comp for 5 referrals

Get a 6 month comp for 25 referrals

Leaderboard leaders:

At the end of each month the current leader will receive a free Contrarian Investor mug. Will even pay for shipping!

Share this post