Good morning contrarians! Welcome to the Daily Contrarian, our morning look at events likely to move markets. It is Monday, Sept. 23. The Bottom Line segment of today’s podcast starts at (3:15) and Stocks on the Contrarian Radar©️ at (5:49) for listeners who want to skip ahead.

State of Play

As we eye our board of indicators for signs of direction at 0655, things are pretty quiet though tilted to risk-on:

Stock index futures are pointing to modest gains, led by small caps. The Russell 2000 is up 0.4%. Nasdaq futures 0.3% to the good, followed by S&P 500 futures (+0.2%);

Commodities aren’t doing much. WTI crude oil is unchanged, trading around $71/barrel. Copper prices aren’t moving at all from the break-even point;

Cryptos are up a bit with Bitcoin 1.5% higher to trade around $63,500;

Bonds are flat. The 2-year yields 3.57% whilst the 10-year yields 3.75%. Looks like yield curve uninversion is for real.

Today’s Known Events

A flash reading of S&P Purchasing Manager Indexes are out at 0945. As this is the first look at this month’s PMIs, it bears watching — and could move markets (it has in the past).

Economists who were surveyed expect the Services PMI to print at 55.3 after coming in at 55.7 last month. The Manufacturing PMI is expected to come in at 48.6, which would be an improvement over the 47.9 recorded last month. The 50 line separates expansion from contraction, so according to this services are in expansion territory while manufacturing remains in recession.

We also have some Fed speakers:

Atlanta Fed President Raphael Bostic speaks on the economic outlook at 0800. Bostic is a full FOMC voting member this year;

Chicago Fed President Austan Goolsbee provides the keynote at the National Association of State Treasurers Annual Conference at 1000. Gooslbee is an alternate FOMC voting member this year.

The Bottom Line

Last week was a good one for stocks. Dow Industrials closed at a fresh record high. We know better than to follow the Dow, which contains just 30 stocks, preferring the S&P 500 as fairer gauge of the market at large. But those other indexes also had good weeks.

The Fed has cut rates and is expected to do so again at its next meeting on Nov. 7, judging by Fed Fund Futures. The latest escalation in the Middle East is being widely ignored. Investors don’t appear particularly plussed at who becomes president either. All systems go for the bull market to continue?

There isn’t much on the calendar this week. Plenty of Fed speakers to keep people’s interest in that. Micron (MU 0.00%↑) and Costco (COST 0.00%↑) report earnings. On Friday we have the latest PCE Deflator, the Fed’s preferred inflation gauge, but that is no longer the event it once was as inflation is no longer seen as a very serious risk.

Stocks on the Contrarian Radar©️

Intel (INTC 0.00%↑) continues to gain ground as it looks increasingly like there could be a bidding war for the company’s assets — or maybe to take it over outright. Private equity is the latest to enter the fray, with Apollo Global reportedly looking to invest. As you can see, Intel’s stock has recaptured all the ground it lost over the last three weeks:

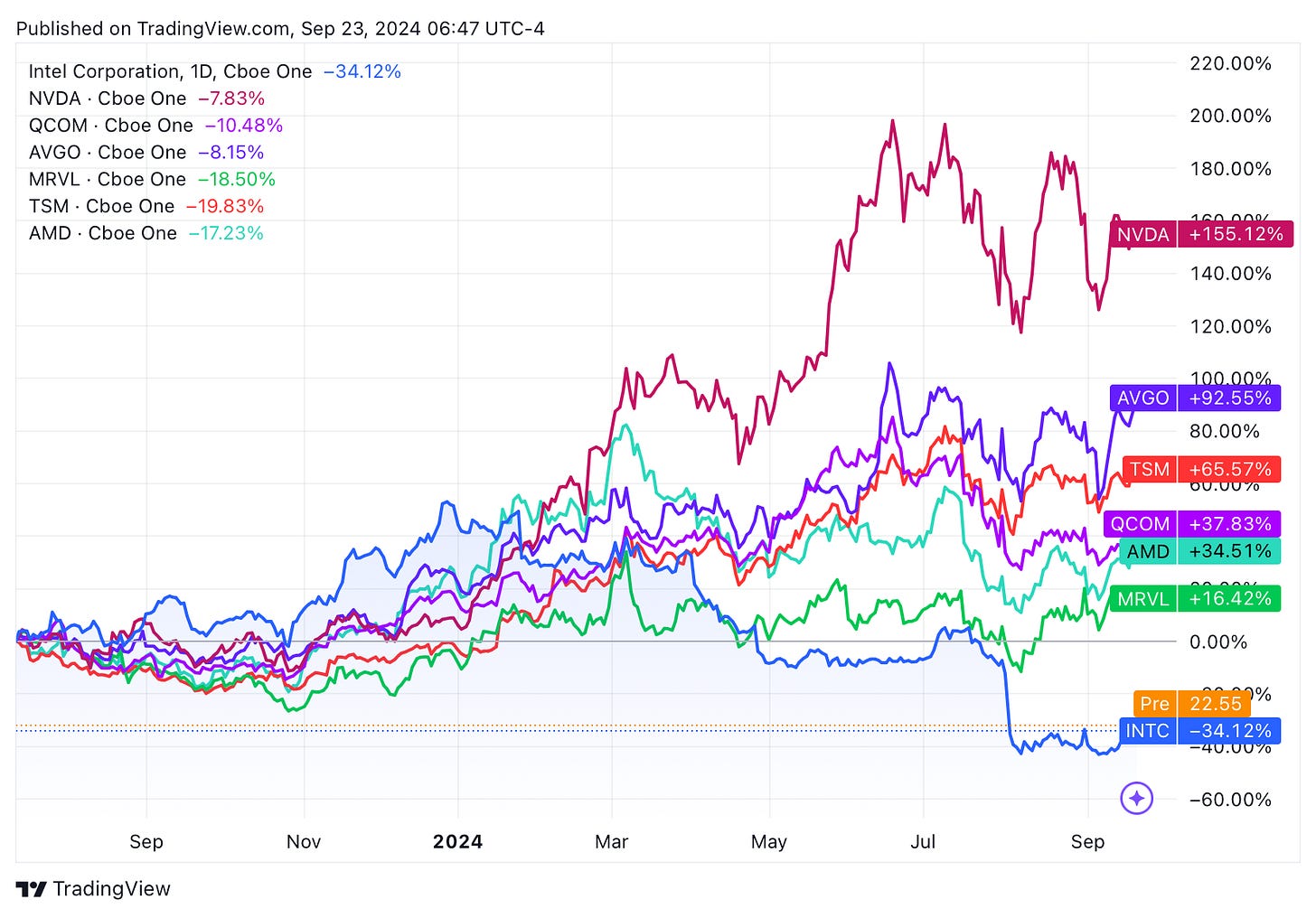

And there may be more upside ahead, if one judges where INTC trades compared to other AI chip names such as Nvidia (NVDA 0.00%↑), AMD (AMD 0.00%↑), Qualcomm (QCOM 0.00%↑), Broadcom (AVGO 0.00%↑), Taiwan Semiconductor (TSM 0.00%↑), or Marvell (MRVL 0.00%↑). Indeed, Intel is the only one of these to be negative over the last 12 months:

More importantly, healthy M&A speaks to a healthy capital market, which speaks to more healthy risk-taking by financial and corporate interests, which generally speaks to higher prices for stocks. But it’s important to follow these Intel divestitures to see what it says about AI chip assets. Chances are, these things are badly needed by corporations the world over — and especially in the US, which is keen to divorce itself from anything Chinese. As a US company — and military contractor to boot — Intel ticks a bunch of boxes there.

Housekeeping

Obviously this is not investment advice (duh). Do your own research, make your own decisions.

This Substack chat tracks The Contrarian’s trades in (almost) real time.

If this daily thing is drowning your inbox and/or you CBF to bother with it and prefer to just get the guest feature or actionable highlights — you can control these settings on your account page.

Finally, if you enjoy this and want others to experience it, please gift a subscription to your friends (or even your enemies).

Share this post