Good morning contrarians! Welcome to the Daily Contrarian, our morning look at events likely to move markets. It is Wednesday, Nov. 13. The Bottom Line segment of today’s podcast starts at (4:15) followed by Stocks On The Contrarian Radar©️ at (6:39) feat HOG 0.00%↑ for listeners who want to skip ahead.

State of Play

Stocks dropped yesterday for the first time since the election. As we eye our board of indicators for signs of direction at 0630, things appear quiet:

Cryptos appear to be stabilizing after dropping overnight. Or at least Bitcoin is, up <1% to trade around $87,800;

Stock index futures are effectively flat with no major US index moving more than 0.2% from the break-even point;

Commodities aren’t doing much either. WTI crude oil is up 0.8% to trade around $68.50. Copper is unchanged;

Bonds are unchanged. The 2-year yields 4.35%. The 10-year yield is 4.43%. So the 2/10 gap is back up to 8 basis points.

Today’s Known Events

Inflation is back on the menu. No sooner had we thought the inflation dragon was slayed, that higher prices are suddenly back in focus. Part of this is also a reaction to political events as Trump’s policies (like Kamala Harris’, it’s worth pointing out) are expected to be inflationary. The data will be released at 0830, per usual.

Anyway, the numbers we’re looking for are as follows:

Headline CPI of 0.2% month-over-month, the same as last month;

This would raise annualized headline CPI to 2.6% from 2.4%;

Core CPI, which excludes food and energy, is expected to print at 0.3% MoM, which would leave it at 3.3% YoY. Both of these are unchanged from last month.

One earnings of note: Cisco (CSCO 0.00%↑) reports after the close at 1600.

The Bottom Line

Investors appear to be waiting out the inflation print. The overall figures are still not terrible, though core CPI is stubbornly persistent above 3%. A move higher into the mid-3% range could certainly unnerve some people.

You’re going to want to watch short-term bond yields and of course Fed fund futures. These are still, at this writing, pricing in another 25bps rate cut at the next FOMC meeting, which is Dec. 18, to the tune of 82%. If the CPI comes in hot, you can expect that number to drop, perhaps dramatically.

Overall, it is fair to say that inflation is once again a concern. For now. If today’s print comes in soft then it could unleash more animal spirits.

Stocks On The Contrarian Radar©️

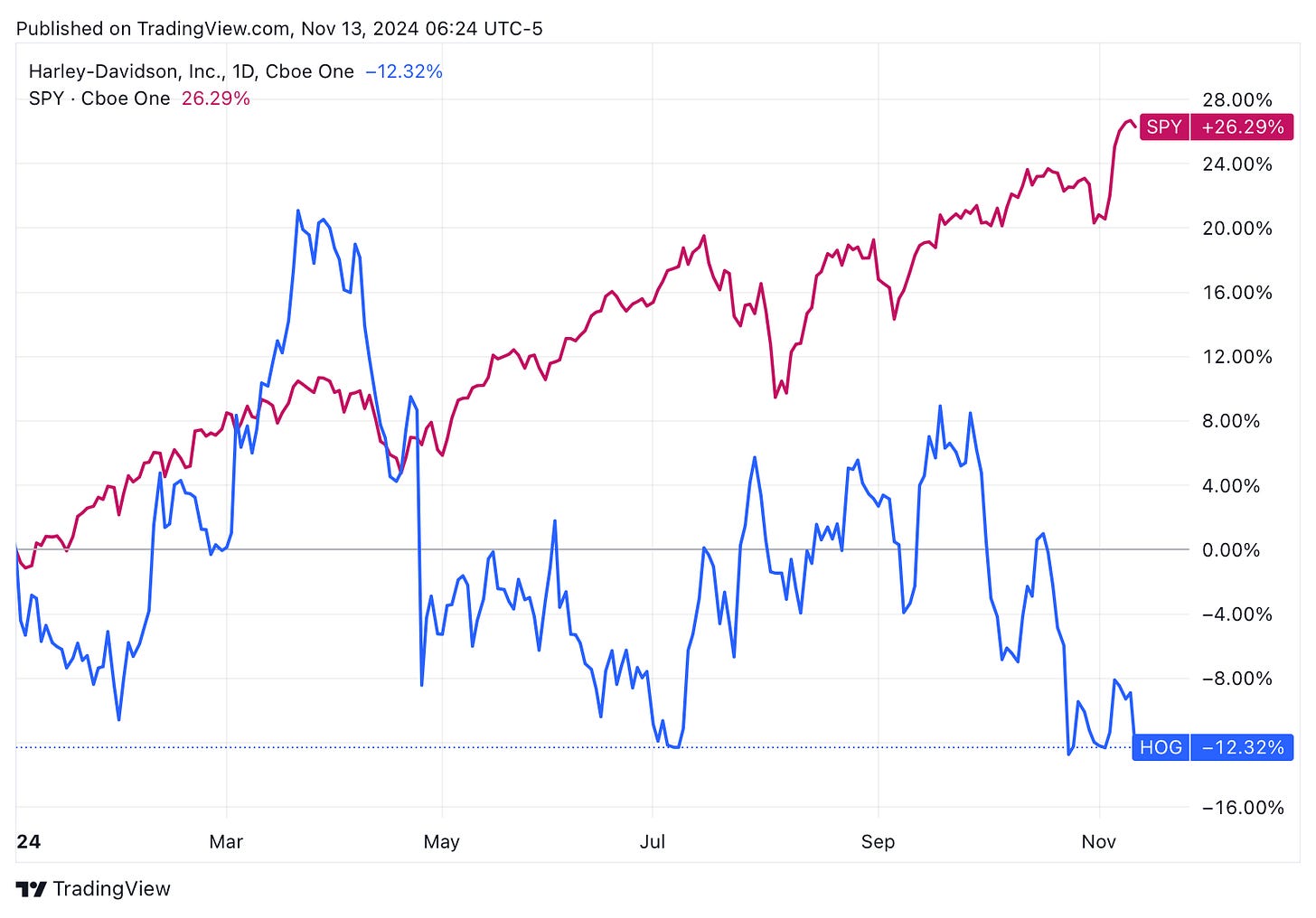

Harley Davidson (HOG 0.00%↑) dropped by almost 4% yesterday to its lowest level of the year. The stock is now down 12% year-to-date, which is particularly embarrassing if you hold it up against the S&P 500 (SPY 0.00%↑):

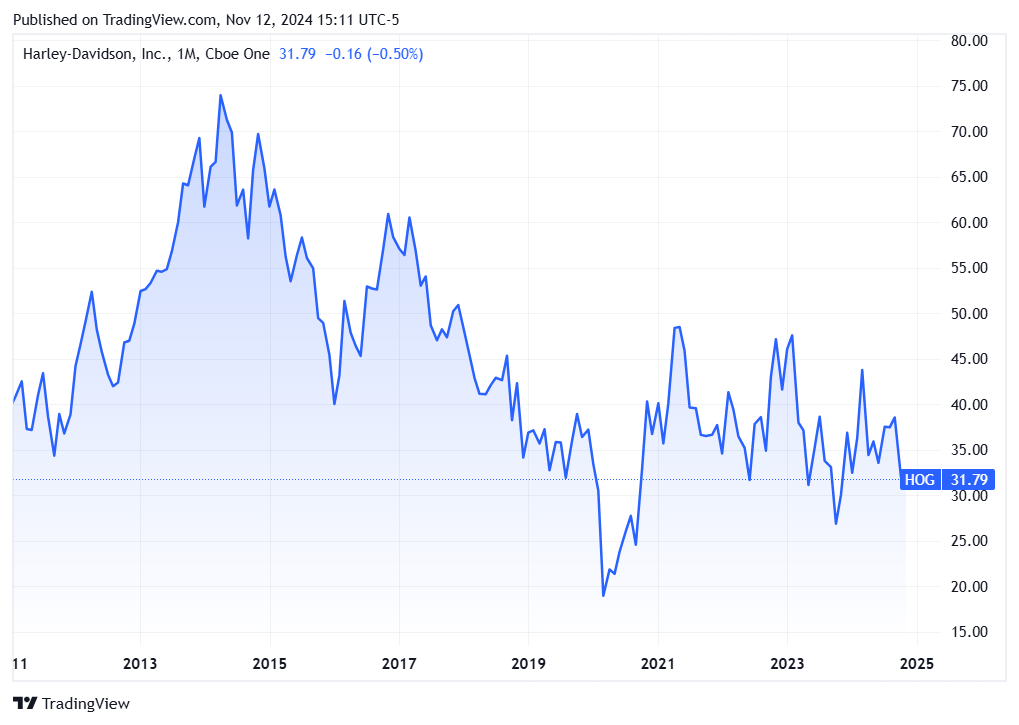

The concern is apparently Trump tariffs, which hurt the company the last time around. The first Trump term was not good for Harley Davidson. It stock basically went nowhere for four years. Not that the last four years were much better. In fact, you have to go back to the Obama era to see HOG above $40 for any extended period of time:

That kind of set up looks like it could make for a contrarian buying opportunity. The valuation is pretty compelling. HOG trades at:

9x forward earnings;

1x forward sales;

3.5x forward cashflows

Cheap, cheap, and cheap! Management has also been buying back shares aggressively. Harley-Davidson is a very well-recognized brand with a loyal following. So why is the stock going nowhere and taking on more water as we embark on another ‘buy America’ Trump term?

(Meme by author via Grok)

Well for starters the sales multiple is not that compelling for a company like Harley Davidson as it’s hard to see where growth is going to materialize. The company does have an electrical motorcycle division, called LiveWire, but how much fun can electric motorbikes be? Do they even make any noise? Isn’t part of the point of owning these things to let the engine howl at unsuspecting civilians?

Indeed the company has, by its own admission, been losing market share. It doesn’t say to whom, but it’s evaporating pretty badly. Operating margins aren’t great either, at 28% (gross). HOG is a cyclical business and it’s clear we’re closer to the end of the economic growth cycle than its beginning.

Add it all up, and take the coming tariffs and it’s pretty hard to justify buying at these prices. However if it were to drop below $30, then it could be a lot more justifiable. Just don’t expect to recoup your investment anytime soon. But as a long-term trade, it may work out. You do get a dividend of 2% (at today’s prices) for your troubles.

Disclosure: The Contrarian owns a tiny slug of HOG in a retirement account.

Housekeeping

Obviously this is not investment advice (duh). Do your own research, make your own decisions.

Read this month’s portfolio update letter here. The Substack chat tracks The Contrarian’s trades in (almost) real time.

If this daily thing is drowning your inbox and/or you CBF to bother with it and prefer to just get the guest feature or actionable highlights — you can control these settings on your account page.

Finally, if you enjoy this and want others to experience it, please gift a subscription to your friends (or even your enemies).

Share this post