Good morning contrarians! Welcome to the Daily Contrarian, our morning look at events likely to move markets. It is Friday, July 5. The Bottom Line segment of today’s podcast starts at (2:54) for listeners who want to skip ahead. Be sure to check out the new ‘One Year Ago Today’ section at the bottom of this page.

State of Play

Welcome back from the July 4 holiday. We had elections in the UK and Bitcoin enter a bear market after this latest turn for the worse. As we eye our board of indicators for signs of direction at 0555, there isn’t much action outside the aforementioned cryptocurrencies:

Things are ugly there, with Bitcoin down another 5% to trade below $54,500. Ethereum is down 9%, Solana 6%;

Stock index futures are so far unchanged with the exception of small caps. The Russell 2000 is down 0.6%;

Commodities are mixed. Copper is rallying, up more than 2%. WTI crude oil is unchanged trading around $84/barrel;

Bonds are unchanged. The 2-year yields 4.69% whilst the 10-year yields 4.34%.

Today’s Known Events

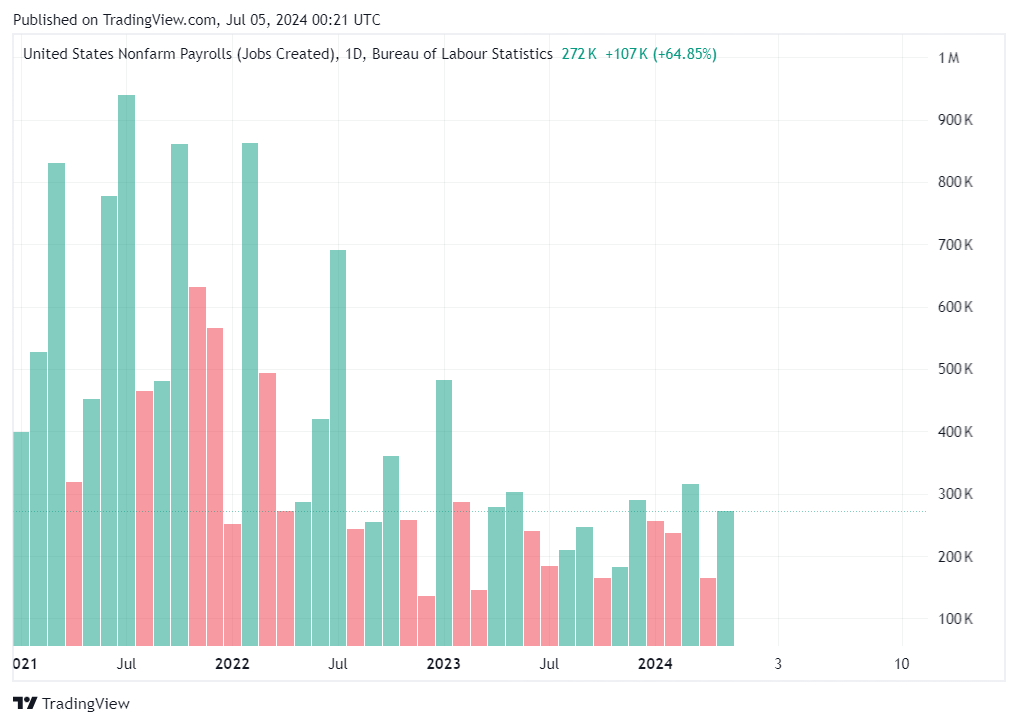

It’s all about non-farm payrolls, out at 0830. Economists who were surveyed expect 194,000 new jobs, which would be a pretty significant decrease from the 272,000 recorded last month. Private payrolls are expected to be even lower, at 160,000 after 229,000 last month. That would leave the unemployment rate unchanged at 4.0%.

As you can see, non-farm payrolls have been trending lower over the last 18 months:

The Bottom Line©️

After Powell’s comments on Tuesday and non-manufacturing PMIs on Wednesday, the market will be expecting more softness from today’s NFPs. If that happens, it should help bonds and stocks because it will further help the case for rate cuts in September. Fed fund futures are now pricing in a 67% chance of that happening, up from below 60% just a week ago.

Where Bitcoin is concerned, these have so far not worked as a leading indicator for stocks on the way down (it’s been a different story where uptrends in the stock market are concerned, going back to the bank failures last spring). The S&P and Nasdaq closed at record highs Wednesday even as Bitcoin dropped. Yes, BTC’s descent is more than a month in the making already. As you can see, the S&P has so far not only not played along, but actually moved inversely:

And so we must ask if this new Bitcoin bear market is just cryptos being cryptos or perhaps a sign of something more sinister. It makes sense that cryptos would be a leading indicator for stocks seeing how these are completely synthetic securities with no underlying value (sorry, it’s true. other than an algorithm) that literally trade on the whims of investors. Shouldn’t that be a reflection of the market’s broader psychological state? And shouldn’t that eventually impact other segments of the market?

So far it hasn’t. Time will tell if this logic holds up on the way down the same way it has on the way up. The Contrarian, for one, is nervous.

One Year Ago…

Fed fund futures were pricing in an 86% chance of a rate hike at last July’s FOMC meeting (Daily Contrarian, July 5, 2023).

…And What Happened

Indeed the Fed did hike rates, by 25bps as anticipated at the July 26, 2023 meeting. It would be the last time the Fed touched the interest rate dial. Every meeting since then has seen no change to the key policy rate. The same is expected for this month’s meeting, according to Fed fund futures.

Housekeeping

Obviously this is not investment advice (duh). Do your own research, make your own decisions.

This Substack chat tracks The Contrarian’s trades in (almost) real time. The full portfolio is available upon request.

If this daily thing is drowning your inbox and/or you CBF to bother with it and prefer to just get the guest feature or actionable highlights — you can control these settings on your account page.

Finally, if you enjoy this and want others to experience it, please gift a subscription to your friends (or even your enemies).

Share this post