Good morning contrarians! Welcome to the Daily Contrarian, our morning look at events likely to move markets in the day ahead. Today is Friday, July 28.

State of Play

Yesterday was pretty weird, with a rally reversing around mid-day. Dow Industrials closed lower for the first time in 14 trading days. Then we had some more positive earnings after the close, with Intel (INTC 0.00%↑) and Roku (ROKU 0.00%↑) beating estimates. Finally overnight the Bank of Japan surprised everybody by loosening its yield curve control and signaling “greater flexibility.” As of 0635 markets in the US at least are looking to resume their rally:

Stock index futures are pointing to gains at the open, led by tech. The Nasdaq is up 0.8%. S&P 500 futures are 0.4% to the good;

Bonds are seeing a few bids reversing a sell-off from yesterday. The yield on the 2-year down 7 basis points to 4.88% whilst the 10-year is down 4bps to 3.98% (yields move inversely to prices);

Commodities aren’t doing much. WTI crude oil is trading around $79.50/barrel, roughly unchanged. Copper is up 0.5%.

Known Events

We start once again with earnings. Several of these up today. Chevron (CVX 0.00%↑) just reported a surprising earnings miss and Exxon Mobil (XOM 0.00%↑) is due intermittently.

We’re also due to hear from staples stalwarts Procter & Gamble (PG 0.00%↑) and portfolio company Colgate Palmolive (CL 0.00%↑). Another portfolio company, Newell Brands (NWL 0.00%↑) also reports before the open. So does another staples company Church & Dwight (CHD 0.00%↑)

Personal Consumption Expenditures, the Fed’s preferred inflation gauge, is out at 0830. This could be important for future Fed policy, though we have almost two months before the next FOMC meeting.

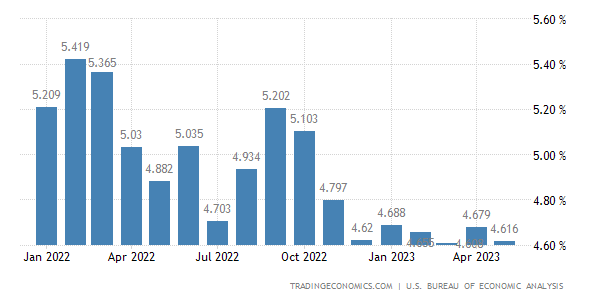

Economists expect a month-over-month increase of 0.2% for the core PCE, which excludes food and energy. That would translate to 4.2% year-over-year, down from the 4.6% seen last month. There doesn’t appear to be an economist estimate for the headline figure which is just as good because it’s far less important.

As you can see from the above chart, annualized core PCE has come down quite a bit from its heights in 2022. If we do get a 4.2% print today that would be the lowest level since September 2021.

The Bottom Line©️

So that headline (“lowest level since September 2021”) writes itself. It will likely have already been written seeing how these inflation readings rarely miss estimates by very much. So the chances we get 4.5% or higher is quite minimal indeed. But the devil is in the details and if we don’t get 4.2% but are still below 4.6%, then that 2021 headline will still apply — however investors will know that the result will still be hotter-than-anticipated inflation, which will be a negative for risk assets because it means the Fed may have more work to do in fighting inflation. That means higher for longer interest rates, which is bad for stocks and bonds alike.

Bond markets will tell the story more immediately and you can of course also look to Fed fund futures. At the time of this writing these are pricing in just a 22% chance of a rate hike at the next FOMC meeting on Sept. 26. But if today’s PCE Deflator comes in hot, you can expect that to bounce and for bond yields (which move inversely to prices) to spike as well.

If the PCE comes in soft then the ‘soft landing’ narrative will gain steam again. Not that it’s gone anywhere, but it will definitely get louder. Then one would expect stocks to rally, but then with yesterday afternoon’s sell-off (on no new information) it looks like investors might be getting a little tired of bidding things up. We’ll just have to see how the day unfolds.

Housekeeping

Obviously this is not investment advice (duh). Do your own research, make your own decisions.

The Substack chat tracks The Contrarian’s trades in (almost) real time. The full portfolio is available upon request.

Be sure to check out our Substack notes, for more contrarian thoughts and missives throughout the day.

If this daily thing is drowning your inbox and/or you CBF to bother with it and prefer to just get the guest feature or actionable highlights — you can control these settings on your account page.

Also:

Please take the listener survey! It’s like, five questions and should only take a few minutes of your time. You can win free merchandise. A lucky respondent will be selected each month to receive a classic crew-neck T-shirt.

Referrals. The best way to support this work. Invite friends to subscribe and read/listen with us. Use this referral link:

There are benefits:

Get a 1 month comp for 3 referrals

Get a 3 month comp for 5 referrals

Get a 6 month comp for 25 referrals

Leaderboard leaders:

At the end of each month the current leader will receive a free Contrarian Investor mug. Will even pay for shipping!

Share this post