Good morning contrarians! Welcome to the Daily Contrarian, our morning look at events likely to move markets in the day ahead. Today is Wednesday, Jan. 17, 2024. The Bottom Line segment of today’s podcast starts at (5:37) for listeners who want to skip ahead.

Today’s briefing and podcast is a rare free version. Enjoy and update your subscription if you want to receive these every morning:

State of Play

Stocks sold off yesterday with small caps seeing the worst of it, thus resuming the theme we saw most of last week. Overnight we had China GDP print below forecasts, Tesla (TSLA 0.00%↑) slash car prices in Europe and China, and hotter-than-anticipated UK inflation. As we look at our board of indicators at 0640, this all seems to be weighing on markets:

Stock index futures are pointing to losses at the open, with small caps leading the drop again. The Russell 2000 is down 1.3% whilst Nasdaq and S&P 500 are off about 0.4%;

Commodities are dropping. WTI crude oil is down almost 2% to trade around $71/barrel whilst copper is down 0.3%;

Bonds are selling off at the short end of the curve, perhaps an indication of concerns over Fed rate hikes. The 2-year yield is up 6 basis points to 4.29%. The 10-year is unchanged at 4.06% (yields move inversely to prices).

Earnings

Charles Schwab (SCHW 0.00%↑), Prologis (PLD 0.00%↑), US Bancorp (USB 0.00%↑), and Citizens Financial Group (CFG 0.00%↑) report before the open at 0930.

After the close at 1600 we’ll hear from Alcoa (AA 0.00%↑), Discover Financial Services (DFS 0.00%↑), and Kinder Morgan (KMI 0.00%↑) among others.

Economic Data

Retail sales are out at 0830. This is a crucial reading on the state of the US consumer, which probably makes it the key economic data release of the day. Economists who were surveyed expect an increase of 0.4% month-over-month after 0.3% last month. Core retail sales, which exclude automobiles, are expected to come in at 0.2% MoM, the same as last month.

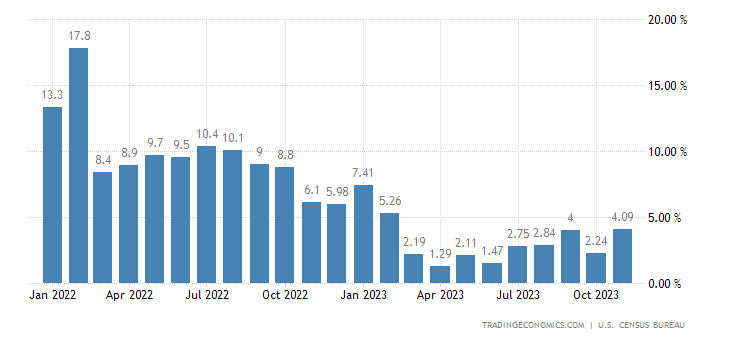

As you can see the annualized retail sales figure has started to accelerate again after several months of lackluster increases in the middle of last year:

We get another reading on inflation in the form of import and export prices, also at 0830. The expectation here is for a drop of 0.6% MoM for export prices, less than the 0.9% decline seen a month ago. Import prices are also expected to drop by 0.5% MoM versus 0.4% a month ago. There are obviously other factors at work here other than pure inflation, such as demand by importers and exporters.

Industrial and manufacturing production is out at 0915. No change is expected to each monthly figure after seeing a 0.2% MoM increase (for industrial production) and 0.3% MoM (for manufacturing) last month.

Some other data releases today: retail inventories, capacity utilization, the NAHB Housing Market Index, and the Fed’s Beige Book.

The Bottom Line©️

The US is the most single powerful block of consumers in the world. As the American consumer goes, so goes the global economy. Retail sales unexpectedly accelerated the last couple of months, right when it was starting to look like Americans had finally started to run out of things to buy. It turns out Americans’ propensity to spend (mostly on stuff they don’t need) was underestimated by even the most optimistic forecaster.

Now we’ll see how long this can persist. As long as Americans are employed and have steady paychecks it stands to reason that it can keep going. We probably won’t see anything like the numbers from 2022 again, perhaps ever, but even low single digits is great news to anybody manufacturing a product for US consumption.

The news from China is not good but it has been known for some time that China’s economy is in all kinds of trouble. The question is how important Chinese consumers are to the whole global economic equation. They certainly aren’t nothing and their retrenchment will certainly take its toll on western producers of consumer goods. Tesla is just one obvious example but there are many others. But as long as Americans can pick up the slack, the global economy can continue to soldier on — or so the thinking goes.

Housekeeping

Obviously this is not investment advice (duh). Do your own research, make your own decisions.

This Substack chat tracks The Contrarian’s trades in (almost) real time. The full portfolio is available upon request.

If this daily thing is drowning your inbox and/or you CBF to bother with it and prefer to just get the guest feature or actionable highlights — you can control these settings on your account page.

Please take the listener survey! It’s like, five questions and should only take a few minutes of your time. You can win free merchandise. A lucky respondent will be selected each month to receive a classic crew-neck T-shirt.

Share this post