Good morning contrarians!

Stock futures are flat as of 0630. Major indexes are all hogging the break-even point. Bonds are seeing some bids, with the yield on the 10-year back down to 1.6%. Cryptocurrencies have fallen off a bit of a cliff, with bitcoin down 9% to trade around 60,000. Insert joke about cryptos being a stable source of value.

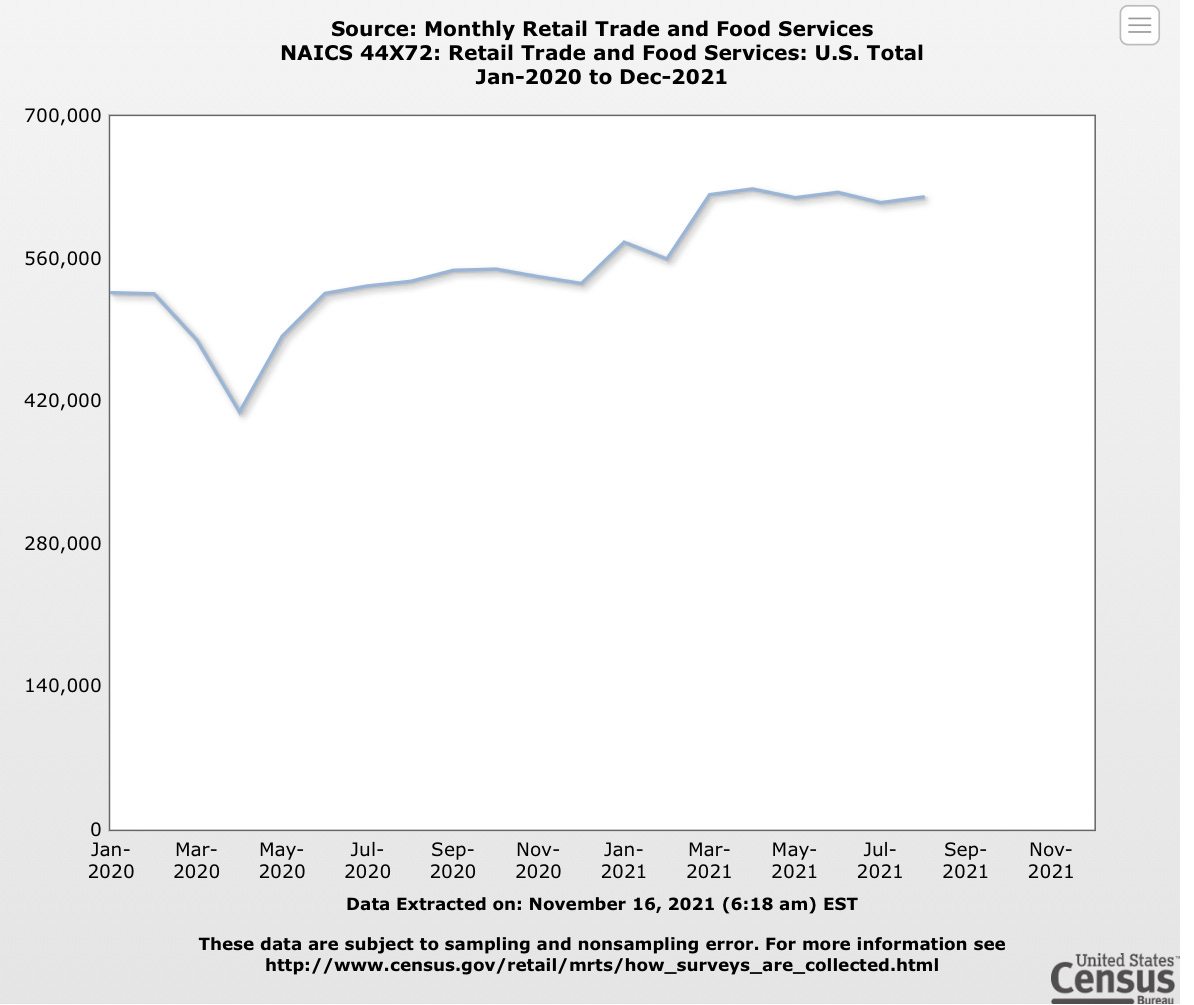

Today is all about retail. The U.S. Census Bureau releases its retail figures for October at 0830. Expectations are for a month-over-month increase of 1% for core retail sales, an improvement on last month’s 0.7%. This figure has been holding pretty steady for a couple of months. There were some unanticipated drops of 1% or more over the summer. The consensus estimate tends to miss pretty widely for this data point, so it may not be worth putting too much faith in it. The details of the report could be more telling.

We also have a couple of major retail companies reporting earnings today. The first of these, Home Depot (HD), just topped estimates for earnings and revenue. Same-store sales climbed 6.1% for the quarter, compared to a consensus estimate of 2.2%. That’s pretty impressive and speaks to how much Americans are still spending on repairing and improving their homes. Also, what supply chain issues?

Walmart (WMT) just beat earnings estimates on the top- and bottom-line as well, and raised full-year guidance. Another positive for retail and for stocks. Also, what supply chains? At 1000 we should get retail inventories ex-autos for September.

The virtual meeting between President Biden and Xi Jinping of China turned into a bit of a non-event. The meeting apparently lasted more than three hours and the two heads of state sought to play down hostilities, which is a positive. On the Taiwan issue, it sounds like the U.S. will continue to walk the tightrope of not supporting ‘independence’ while not trying to change the system of government in mainland China. Like I said, no developments.

Bottom Line

The crypto selloff is a bit worrisome for risk appetite. As we’ve seen, major moves in cryptos have been a harbinger of stocks. It’s not entirely clear what’s going on there. If cryptos are just being cryptos then the retail trade report should determine the direction of the day. If the crypto sell-off intensifies it should lead to selling elsewhere.

Yesterday’s Bottom Line told you it was likely to be a quiet trading day. Indeed, not much happened and stocks finished flat on the day. The Biden-Xi summit turned into a non-event however.

Share this post