Good morning contrarians!

Stock futures are sinking over renewed tensions between Russia and Ukraine. There were reports of shelling overnight as the encouraging news of a Russian pullback was refuted by U.S. officials.

As of 0630, small caps are seeing the worst of it with the Russell 2000 down about 0.9%. The Nasdaq is off about 0.7% with Dow Industrials and S&P 500 pointing to a drop of 0.5% at the open.

Gold is seeing bids over this news, trading about 1% higher to close to $1900/oz. Crude oil and natural gas are down however, with WTI off about 2% to trade around $91.50/barrel and natural gas down 3% to $4.50. Industrial metals are continuing to rise, with aluminium, zinc, and nickel up 1% or more. Copper is flat.

Bonds are also moving higher, especially at the short end of the curve. The yield on the 2-year is down to 1.48% from 1.52% (yields move inversely to prices). The 10-year yield is down to 2.01% from 2.04%.

Cryptos are dropping, with bitcoin down about 2% to trade around $43,000.

Today’s Data

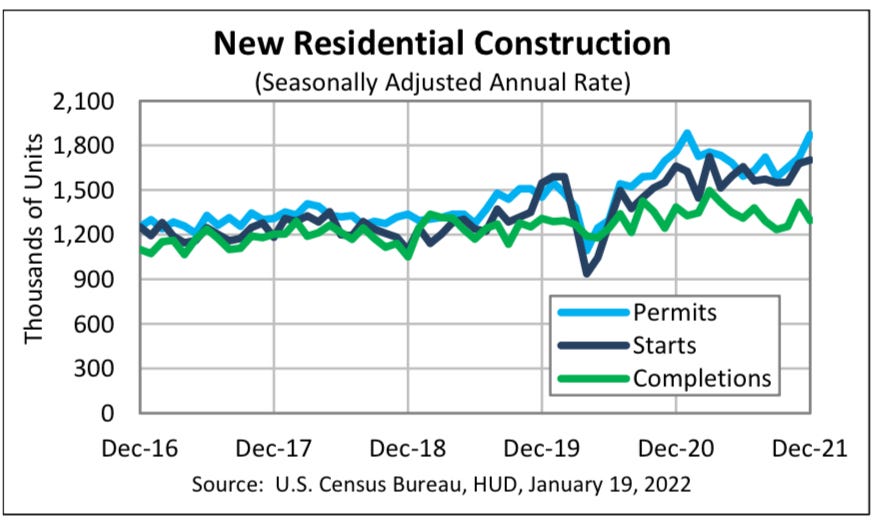

It’s a big day for housing data. Building permits for January are out at 0830 along with housing starts. These are the two most forward-looking indicators for the U.S. housing market, which in turn carries the fortunes of much of the global economy.

Building permits are expected to have increased by 1.76 million in January, slightly less than the record 1.87 million seen in December. Housing starts are expected to have increased by 1.7 million last month, roughly in line from where they were in December. This number too is near record highs.

What this tells us is that the residential real estate market is very healthy indeed. As long as that holds up, the global economy should follow.

We also have initial jobless claims out at 0830. Economists expect 219,000 new claims this week, a slight drop from last Wee’s 223,000. The post-pandemic low was 184,000 set back on Dec. 9.

St. Louis Fed president James Bullard and Cleveland Fed president Loretta Mester are speaking today, but it’s hard to see what they can say to move markets now. We already know Bullard is hawkish and Mester less so. Presumably this is all jockeying ahead of the FOMC meeting on March 16. It doesn’t sound like the Fed will move before then, especially with all the geopolitical tension.

On the subject of speakers, Bernie Sanders and Elizabeth Warren will appear at a Senate hearing on ‘Wall Street Greed.’ Apparently they tried to get CEOs of BlackRock, Blackstone, and Apollo to appear, but were weirdly ignored in their request.

Earnings

Walmart (WMT) just beat on top- and bottom-line estimates, but US Foods (USFD) fell short of EPS estimates and that stock is selling off. Palantir (PLTR) and AutoNation (AN) are also due out before the open at 0930. After the close at 1600 we’ll hear from Roku (ROKU), Shake Shack (SHAK), and Dropbox (DBX).

The Bottom Line

Russia-Ukraine is still at the forefront and can be expected to drive markets again. It’s quite simply impossible to know exactly who or what to believe here, but if you keep an eye on asset prices it may provide some clues.

Gold and U.S. Treasuries rallying means investors are concerned about this, but the drop in crude oil and natural gas says maybe they aren’t concerned that much. If you look at Russian ETFs and ADRs, these are well off the lows of last week. One would expect those to be the first to go if there is a serious chance of an invasion but who knows?

Do your own research, make your own decisions. If you have reliable sources on Russia-Ukraine, on Twitter or elsewhere, by all means clue me in.

Share this post