Good morning contrarians! Welcome to the Daily Contrarian, our morning look at events likely to move markets. It is Thursday, April 3.

Read this month’s portfolio update letter here!

State of Play

President Trump’s ‘Liberation Day’ address yesterday afternoon caused much consternation. Futures plummeted after his speech but appear to have found a bottom. As we eye our board of indicators for signs of direction at 0650, it is very ugly out there:

Stock index futures are down precipitously, but off of the lows. Small caps are leading the drop, with the Russell 2000 down 4.7% (!). Nasdaq futures are down 3.8% and S&P 500 futures off 3.5%. Yes those numbers were worse earlier in the overnight session;

Commodities, too are getting sold. WTI crude oil is down 4.5% to trade around $68/barrel. Copper is down 2.5%. Even gold and silver are retreating, down about 1% each;

Bonds are rallying, keeping with the risk-off theme. The 10-year yield is down 12 basis points to 4.07%, its lowest point of the year;

Cryptos are, perhaps amazingly, holding up okay in the scheme of things. Bitcoin is down just 2% to trade around $83,000. If there’s reason for hope, it’s this.

Today’s Known Events

A few earnings to start us off:

Lamb Weston (LW 0.00%↑), the potato supplier that caused so much consternation last summer, was due to report at 0630 but has not yet;

MSC Industrial Direct (MSM 0.00%↑), a metalworking company, missed estimates and initiated an outlook. Unfortunately the futures prices haven’t updated for this security so no way of telling how the market is reacting;

Conagra Brands (CAG 0.00%↑), producer of packaged foods (Slim Jim is perhaps the most recognized one) is also out before the open at 0930;

It’s Thursday so we’ll get initial jobless claims at 0830 ET. Economists who were surveyed expect 225,000 new claims this week, effectively in line with the 224k recorded last week and right in line with the four-week average which is 224k.

The US reports its trade balance at 0830 as well. The expectation here is for a trade deficit of $123 billion, down a bit from the $131 billion recorded last month.

ISM non-manufacturing (read: services) PMIs are out at 1000 ET. A reading of 53.0 is expected. That’s down a bit from the 53.5 recorded last month but still comfortably above the 50 line that separates expansion from contraction.

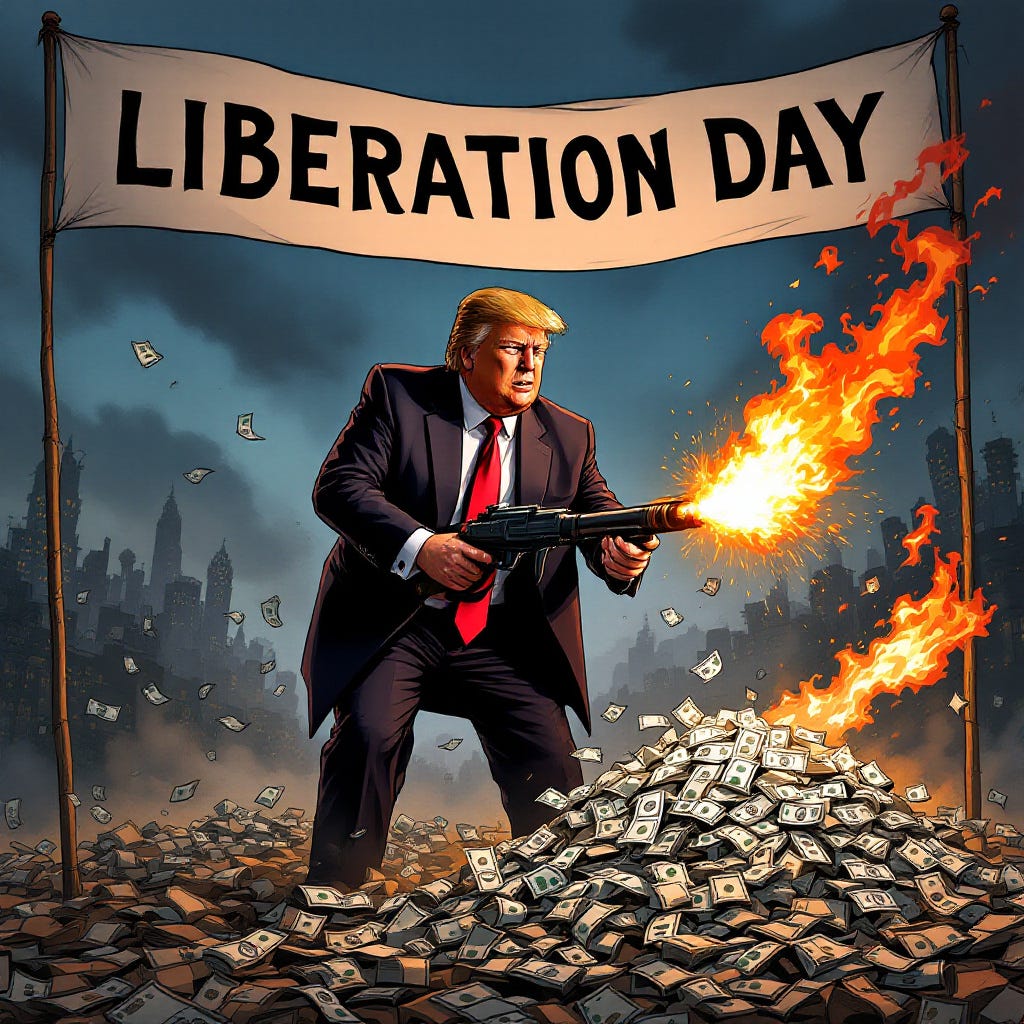

(It certainly looks like Trump has taken a flamethrower to markets, at least for now. Art by author via AI)

The Bottom Line

So apparently tariffs can still scare investors. The question we once again have to ask is this:

Can these tariffs cause the economy to enter recession?

Listen to this episode with a 7-day free trial

Subscribe to Contrarian Investor Premium to listen to this post and get 7 days of free access to the full post archives.