Good morning contrarians! Welcome to the Daily Contrarian, our morning look at events likely to move markets in the day ahead. Today is Thursdau, Feb. 8, 2024. The Bottom Line segment of today’s podcast starts at (5:55) for listeners who want to skip ahead.

State of Play

Stocks advanced again yesterday and the after hours saw positive earnings results from Disney (DIS 0.00%↑) and Arm Holdings (ARM 0.00%↑). As we look at our board of indicators at 0630, there is no clear direction yet:

Stock index futures are pointing to a slightly lower open, with small caps leading the drop again. The Russell 2000 is down 0.5% while S&P 500 and Nasdaq are down about 0.2% each;

Commodities are mixed. WTI crude oil is up 1% to trade around $74.50/barrel and natural gas is up 1% but copper is down 0.2%;

Bitcoin is rallying a bit. We haven’t talked about cryptos in awhile because they haven’t really done anything, but BTC is up 4% to trade close to $45,000;

Bonds are flat. The 2-year yields 4.43% whilst the 10-year yield is 4.13%.

Economy

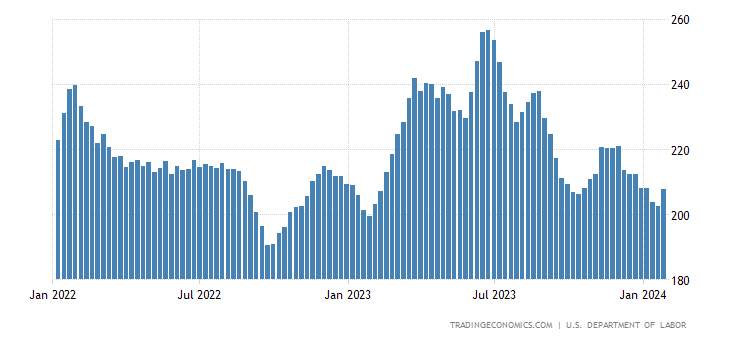

It’s Thursday so we’ll get initial jobless claims at 0830. Economists expect 221,000 new claims, effectively in line with the 224,000 seen last week and ahead of the four-week average of 208,000. Just for fun, here’s a chart of the four-week average dating to the start of 2022:

As you can see these have been trending downward again after a spike last summer.

Listen to this episode with a 7-day free trial

Subscribe to Contrarian Investor Premium to listen to this post and get 7 days of free access to the full post archives.